Exhibit 10.1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

[X] Quarterly report under Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended June 30, 2020

[ ] Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

COMMISSION FILE NO. 1-11602

NANO MAGIC INC.

(Exact name of registrant as specified in its charter)

| Delaware | 47-1598792 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

| 750 Denison Court | ||

| Bloomfield Hills, MI | 48302 | |

| (Address of principal executive offices) | (Zip Code) |

(844) 273-6462

(Registrant’s telephone number, including area code)

| Title of each class | Trading Symbol | Name of Each Exchange on Which Registered | ||

| Common Stock, $0.0001 par value | NMGX | OTC Markets |

Former name or former address, if changed since last report: 701 Brickell Ave, Suite 1550, Miami, FL 33131.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [ ] Yes [X] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [X] Yes [ ] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “accelerated filer”, “large accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Emerging growth company [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [ ] Yes [X] No.

Securities registered pursuant to Section 12(b) of the Act: None

As of September 30, 2020 the registrant had 7,998,456 shares of Common Stock issued and outstanding.

NANO MAGIC INC.

INDEX

| 2 |

FORWARD-LOOKING STATEMENTS

This Form 10-Q contains certain forward-looking statements that we believe are within the meaning of the federal securities laws. For this purpose, any statements that are not statements of historical fact may be deemed to be forward-looking statements, including the statements under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” regarding our strategy, future operations, future expectations or future estimates, financial position and objectives of management. Those statements in this Form 10-Q containing the words “believes,” “anticipates,” “plans,” “expects” and similar expressions constitute forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on our current expectations and are subject to a number of risks, uncertainties and assumptions relating to our operations, results of operations, competitive factors, shifts in market demand and other risks and uncertainties.

Although we believe that the assumptions underlying our forward-looking statements are reasonable, any of the assumptions could be inaccurate and actual results may differ from those indicated by the forward-looking statements included in this Form 10-Q. In light of the significant uncertainties inherent in the forward-looking statements included in this Form 10-Q, you should not consider the inclusion of such information as a representation by us or anyone else that we will achieve such results. Moreover, we assume no obligation to update these forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting such forward-looking statements.

| 3 |

NANO MAGIC INC. AND SUBSIDIARIES

| June 30 | December 31 | |||||||

| 2020 | 2019 | |||||||

| (unaudited) | (unaudited) | |||||||

| ASSETS | ||||||||

| CURRENT ASSETS: | ||||||||

| Cash | $ | 223,739 | $ | 216,801 | ||||

| Investments | 10,473 | 10,236 | ||||||

| Accounts receivable, net | 528,471 | 151,290 | ||||||

| Inventory | 344,023 | 422,622 | ||||||

| Prepaid expenses and contract assets | 186,796 | 34,160 | ||||||

| Total Current Assets | 1,293,502 | 835,109 | ||||||

| Right-of-use assets, non-current | 181,755 | 257,523 | ||||||

| Property, plant and equipment, net | 218,099 | 221,565 | ||||||

| Other assets | 317,608 | 5,890 | ||||||

| Total Assets | $ | 2,010,964 | $ | 1,320,087 | ||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | ||||||||

| CURRENT LIABILITIES: | ||||||||

| Accounts payable | $ | 1,029,995 | $ | 801,788 | ||||

| Accounts payable - related parties | 19,887 | 19,887 | ||||||

| Accrued expenses and other current liabilities | 221,268 | 199,875 | ||||||

| Customer deposits | 5,701 | - | ||||||

| Current portion of notes payable | 95,005 | 52,641 | ||||||

| Advances from related parties | 140,000 | 140,000 | ||||||

| Current portion of lease liabilities | 74,449 | 131,835 | ||||||

| Contract liabilities | - | 162,123 | ||||||

| Total Current Liabilities | 1,586,305 | 1,508,149 | ||||||

| Notes payable, net of current portion | 196,328 | 122,170 | ||||||

| Lease liabilities, net of current portion | 118,320 | 136,624 | ||||||

| Total Liabilities | 1,900,953 | 1,766,943 | ||||||

| Commitments and Contingencies (See Note 11) | ||||||||

| STOCKHOLDERS’ EQUITY (DEFICIT): | ||||||||

| Preferred stock, $0.0001 par value, 100,000 shares authorized; no shares issued and outstanding | - | - | ||||||

| Class A common stock: $0.0001 par value, 7,200,000 shares authorized; 7,199,942 and 6,222,881 issued and outstanding at June 30, 2020 and December 31, 2019, respectively | 720 | 622 | ||||||

| Class B common stock: $0.0001 par value, 2,500,000 shares authorized; 0 shares issued and outstanding at June 30, 2020 and December 31, 2019, respectively | - | - | ||||||

| Class Z common stock: $0.0001 par value, 300,000 shares authorized; 0 shares issued and outstanding at June 30, 2020 and December 31, 2019, respectively | - | - | ||||||

| Additional paid-in capital | 8,458,929 | 7,242,067 | ||||||

| Accumulated deficit | (8,349,638 | ) | (7,689,545 | ) | ||||

| Total Stockholders’ Equity (Deficit) | 110,011 | (446,856 | ) | |||||

| Total Liabilities and Stockholders’ Equity | $ | 2,010,964 | $ | 1,320,087 | ||||

See accompanying notes to consolidated financial statements.

| F-1 |

NANO MAGIC INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

| For the Three Months Ended | For the Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||||||

| REVENUES: | ||||||||||||||||

| Products | $ | 908,062 | $ | 415,832 | $ | 1,149,779 | $ | 872,700 | ||||||||

| Contract services | 244,422 | 206,156 | 450,879 | 507,149 | ||||||||||||

| Total Revenues | 1,152,484 | 621,988 | 1,600,658 | 1,379, 849 | ||||||||||||

| COST OF REVENUES: | ||||||||||||||||

| Products | 600,781 | 390,939 | 823,599 | 588,896 | ||||||||||||

| Contract services | 155,004 | 198,723 | 321,903 | 531,271 | ||||||||||||

| Total Cost of Revenues | 755,785 | 589,6662 | 1,145,502 | 1,120,167 | ||||||||||||

| GROSS PROFIT (LOSS) | 396,699 | 32,326 | 455,156 | 259,892 | ||||||||||||

| OPERATING EXPENSES: | ||||||||||||||||

| Selling and marketing expenses | 4,826 | 17,298 | 15,883 | 25,098 | ||||||||||||

| Salaries, wages and related benefits | 163,831 | 148,186 | 308,465 | 204,698 | ||||||||||||

| Research and development | 14,383 | 41,024 | 31,035 | 56,829 | ||||||||||||

| Professional fees | 359,420 | 72,920 | 484,172 | 152,354 | ||||||||||||

| General and administrative expenses | 136,234 | 140,855 | 273,304 | 280,515 | ||||||||||||

| Total Operating Expenses | 678,694 | 420,283 | 1,112,859 | 719,494 | ||||||||||||

| LOSS FROM OPERATIONS | (281,995 | ) | (387,957 | ) | (657,703 | ) | (459,812 | ) | ||||||||

| OTHER (EXPENSE) INCOME: | ||||||||||||||||

| Interest expense | (519 | ) | (5,159 | ) | (2,627 | ) | (7,753 | ) | ||||||||

| Loss on settlement reserve | - | 4,654 | - | 4,654 | ||||||||||||

| Other income, net | 237 | (3,795 | ) | 237 | 415 | |||||||||||

| Total Other (Expense) Income | (282 | ) | (4,300 | ) | (2,390 | ) | (2,684 | ) | ||||||||

| NET LOSS | $ | (282,277 | ) | $ | (392,257 | ) | $ | (660,093 | ) | $ | (462,496 | ) | ||||

| NET LOSS PER COMMON SHARE: | ||||||||||||||||

| Basic | $ | (0.04 | ) | $ | (0.09 | ) | $ | (0.10 | ) | $ | (0.11 | ) | ||||

| Diluted | $ | (0.04 | ) | $ | (0.09 | ) | $ | (0.10 | ) | $ | (0.11 | ) | ||||

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING: | ||||||||||||||||

| Basic | 7,199,942 | 4,472,389 | 6,850,643 | 4,312,554 | ||||||||||||

| Diluted | 7,199,942 | 4,472,389 | 6,850,643 | 4,312,554 | ||||||||||||

See accompanying notes to consolidated financial statements.

| F-2 |

NANO MAGIC INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

FOR THE THREE MONTHS ENDED JUNE 30, 2020 AND 2019

(unaudited)

| Total | ||||||||||||||||||||||||||||||||||||

| Class A Common Stock | Class B Common Stock | Class Z Common Stock | Additional Paid-in | Accumulated | Stockholders’ Equity | |||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Capital | Deficit | (Deficit) | ||||||||||||||||||||||||||||

| Balance, March 31, 2020 | 7,199,942 | $ | 720 | - | $ | - | - | $ | - | $ | 8,118,444 | $ | (8,067,361 | ) | $ | 51,803 | ||||||||||||||||||||

| Stock-based compensation | - | - | - | - | - | - | 28,767 | - | 28,767 | |||||||||||||||||||||||||||

| Warrants issued in connection with building lease | - | - | - | - | - | - | 311,718 | - | 311,718 | |||||||||||||||||||||||||||

| Net loss | - | - | - | - | - | - | - | (282,277 | ) | (282,277 | ) | |||||||||||||||||||||||||

| Balance, June 30, 2020 | 7,199,942 | $ | 720 | - | $ | - | - | $ | - | $ | 8,458,929 | $ | (8,349,638 | ) | $ | 110,011 | ||||||||||||||||||||

| Balance, March 31, 2019 | 4,299,620 | $ | 429 | - | $ | - | - | $ | - | $ | 6,126,545 | $ | (6,710,609 | ) | $ | (583,635 | ) | |||||||||||||||||||

| Common stock issued for cash, net of issuance costs | 965,115 | 97 | - | - | - | - | 385,950 | - | 386,047 | |||||||||||||||||||||||||||

| Common stock issued for services | 41,814 | 4 | - | - | - | - | 23,996 | - | 24,000 | |||||||||||||||||||||||||||

| Warrants , options, and warrant options on private placement | - | - | - | - | - | - | 28,953 | - | 28,953 | |||||||||||||||||||||||||||

| Net loss | - | - | - | - | - | - | - | (392,257 | ) | (392,257 | ) | |||||||||||||||||||||||||

| Balance, June 30, 2019 | 5,306,549 | $ | 530 | - | $ | - | - | $ | - | $ | 6,565,444 | $ | (7,102,866 | ) | $ | (539,892 | ) | |||||||||||||||||||

See accompanying notes to consolidated financial statements.

| F-3 |

NANO MAGIC INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

FOR THE SIX MONTHS ENDED JUNE 30, 2020 AND 2019

(unaudited)

| Total | ||||||||||||||||||||||||||||||||||||

| Class A Common Stock | Class B Common Stock | Class Z Common Stock | Additional | Accumulated | Stockholders’ | |||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Paid-in Capital | Deficit | Equity (Deficit) | ||||||||||||||||||||||||||||

| Balance, December 31, 2019 | 6,222,881 | $ | 622 | - | $ | - | - | $ | - | $ | 7,242,067 | $ | (7,689,545 | ) | $ | (446,856 | ) | |||||||||||||||||||

| Common stock issued for cash, net of issuance costs | 956,013 | 96 | - | - | - | - | 621,313 | - | 621,409 | |||||||||||||||||||||||||||

| Common stock issued for services | 21,048 | 2 | - | - | - | - | 11,998 | - | 12,000 | |||||||||||||||||||||||||||

| Stock-based compensation | - | - | - | - | - | - | 53,242 | - | 53,242 | |||||||||||||||||||||||||||

| Warrants , options, and warrant options on private placement | - | - | - | - | - | - | 37,058 | - | 37,058 | |||||||||||||||||||||||||||

| Warrants issued in connection with building lease | - | - | - | - | - | - | 311,718 | - | 311,718 | |||||||||||||||||||||||||||

| Stock subscription payable | - | - | - | - | - | - | 181,533 | - | 181,533 | |||||||||||||||||||||||||||

| Net loss | - | - | - | - | - | - | - | (660,093 | ) | (660,093 | ) | |||||||||||||||||||||||||

| Balance, June 30, 2020 | 7,199,942 | $ | 720 | - | $ | - | - | $ | - | $ | 8,458,929 | $ | (8,349,638 | ) | $ | 110,011 | ||||||||||||||||||||

| Balance, December 31, 2018 | 3,741,481 | $ | 374 | - | $ | - | - | $ | - | $ | 5,886,600 | $ | (6,640,370 | ) | $ | (753,396 | ) | |||||||||||||||||||

| Common stock issued for cash, net of issuance costs | 1,523,254 | 152 | - | - | - | - | 609,150 | - | 609,302 | |||||||||||||||||||||||||||

| Common stock issued for services | 41,814 | 4 | - | - | - | - | 23,996 | - | 24,000 | |||||||||||||||||||||||||||

| Warrants , options, and warrant options on private placement | - | - | - | - | - | - | 45,698 | - | 45,698 | |||||||||||||||||||||||||||

| Net loss | - | - | - | - | - | - | - | (462,496 | ) | (462,496 | ) | |||||||||||||||||||||||||

| Balance, June 30, 2019 | 5,306,549 | $ | 530 | - | $ | - | - | $ | - | $ | 6,565,444 | $ | (7,102,866 | ) | (536,892 | ) | ||||||||||||||||||||

See accompanying notes to consolidated financial statements.

| F-4 |

NANO MAGIC INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

| For the Six Months Ended | ||||||||

| June 30, | ||||||||

| 2020 | 2019 | |||||||

| (unaudited) | (unaudited) | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| Net loss | $ | (660,093 | ) | $ | (462,496 | ) | ||

| Adjustments to reconcile net loss to net cash provided by operating activities: | ||||||||

| Change in inventory obsolescence reserve | 86,121 | 17,527 | ||||||

| Depreciation and amortization expense | 8,062 | 26,416 | ||||||

| Bad debt expense | 4,000 | - | ||||||

| Stock-based compensation | 65,242 | 19,853 | ||||||

| Change in operating assets and liabilities: | ||||||||

| Accounts receivable | (381,180 | ) | 185,393 | |||||

| Accounts receivable - related party | - | - | ||||||

| Inventory | (7,523 | ) | 84,991 | |||||

| Prepaid expenses and contract assets | (152,636 | ) | 40,430 | |||||

| Accounts payable | 228,207 | (131,816 | ) | |||||

| Operating lease liabilities | 78 | - | ||||||

| Customer deposits | 5,701 | - | ||||||

| Accrued expenses | 21,393 | (181,850 | ) | |||||

| Contract liabilities | (162,123 | ) | (19,499 | ) | ||||

| NET CASH USED BY OPERATING ACTIVITIES | (944,751 | ) | (382,053 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

| Net activity on certificate of deposit | (237 | ) | - | |||||

Capitalized lease costs | (311,718 | ) | - | |||||

| Purchases of property, plant and equipment | (4,596 | ) | (2,483 | ) | ||||

| NET CASH USED BY INVESTING ACTIVITIES | (316,551 | ) | (2,483 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

| Repayment of bank lines of credit | - | (330,892 | ) | |||||

| Repayment of bank loans | (10,378 | ) | 818 | |||||

| Proceeds from bank loans | 130,900 | |||||||

| Proceeds from sale of common stock and warrants | 1,151,718 | 678,844 | ||||||

| Repayment of notes payable | (4,000 | ) | - | |||||

| NET CASH PROVIDED BY FINANCING ACTIVITIES | 1,268,240 | 348,770 | ||||||

| NET INCREASE (DECREASE) IN CASH | 6,938 | (35,766 | ) | |||||

| CASH, beginning of year | 216,801 | 306,502 | ||||||

| CASH, end of period | $ | 223,739 | $ | 270,736 | ||||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | ||||||||

| Cash paid during the period for interest | ||||||||

| Interest | $ | 2,627 | $ | 7,753 | ||||

See accompanying notes to consolidated financial statements.

| F-5 |

NANO MAGIC INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2020

(UNAUDITED)

NOTE 1 – ORGANIZATION AND BASIS OF PRESENTATION

Organization

Nano Magic Inc. (“we”, “us”, “our”, “Nano Magic” or the “Company”), a Delaware corporation, develops and sells a portfolio of nano-layer coatings, nano-based cleaners, and nano-composite products based on its proprietary technology, and performs nanotechnology product research and development generating revenues through performing contract services. On March 3, 2020, we changed our name from PEN Inc. to Nano Magic Inc.

Through the Company’s wholly-owned subsidiary, Nano Magic LLC, formerly known as PEN Brands LLC, we develop, manufacture and sell consumer and institutional products using nanotechnology to deliver unique performance attributes at the surfaces of a wide variety of substrates. These products are marketed internationally directly to consumers and also to retailers and other institutional customers. On March 31, 2020, PEN Brands LLC changed its name to Nano Magic LLC.

Through the Company’s wholly-owned subsidiary, Applied Nanotech, Inc., we primarily perform contract research services for the Company and for governmental and private customers.

Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”) for interim financial information. Accordingly, they do not include all the information and disclosures required by US GAAP for annual financial statements. In the opinion of management, such statements include all adjustments (consisting only of normal recurring items) which are considered necessary for a fair presentation of the unaudited consolidated financial statements of the Company as of June 30, 2020 and for the three and six months ended June 30, 2020 and 2019. The results of operations for the three and six months ended June 30, 2020 are not necessarily indicative of the operating results for the full year ending December 31, 2020 or any other period. These unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and related disclosures of the Company as of December 31, 2019 and for the year then ended, which were filed with the Securities and Exchange Commission on Form 10-K on May 13, 2020.

Going Concern

These consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the settlement of liabilities and commitments in the normal course of business. As reflected in the consolidated financial statements filed with our Form 10-K on May 13, 2020, the Company had losses from operations and net cash used by operations of $1,031,083 and $878,668, respectively, for the year ended December 31, 2019. Furthermore, at June 30, 2020, the Company had an accumulated deficit of $8,349,638, a stockholders’ deficit of $110,011 and a working capital deficit of $292,803. These factors raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date that the financial statements are issued. Management cannot provide assurance that the Company will ultimately achieve profitable operations or become cash flow positive, or raise additional debt and/or equity capital. During 2018 management took measures to reduce operating expenses. During 2019 and the first two quarters of 2020, management closely monitored costs. In addition, the Company raised equity capital in 2018, 2019 and 2020. These unaudited consolidated financial statements do not include any adjustments related to the recoverability and classification of assets or the amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates

The preparation of consolidated financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. Significant estimates for the three and six months ended June 30, 2020 and 2019 include estimates for allowance for doubtful accounts on accounts receivable, the estimates for obsolete inventory, the useful life of property and equipment, assumptions used in assessing impairment of long-term assets, estimates of current and deferred income taxes and deferred tax valuation allowances, the fair value of non-cash equity transactions, and the fair value of equity incentives.

| F-6 |

Fair Value of Financial Instruments and Fair Value Measurements

The Company adopted the guidance of Accounting Standards Codification (“ASC”) 820 for fair value measurements which clarifies the definition of fair value, prescribes methods for measuring fair value, and establishes a fair value hierarchy to classify the inputs used in measuring fair value as follows:

Level 1-Inputs are unadjusted quoted prices in active markets for identical assets or liabilities available at the measurement date.

Level 2-Inputs are quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, inputs other than quoted prices that are observable, and inputs derived from or corroborated by observable market data.

Level 3-Inputs are unobservable inputs which reflect the reporting entity’s own assumptions on what assumptions the market participants would use in pricing the asset or liability based on the best available information.

The carrying amounts reported in the consolidated balance sheets for cash and cash equivalents, accounts receivable, loans and lines of credit, accounts payable, accrued expenses, and other payables approximate their fair market value based on the short-term maturity of these instruments.

The Company analyzes all financial and non-financial instruments with features of both liabilities and equity under the Financial Accounting Standards Board (“FASB”) accounting standard for such instruments. Under this standard, financial and non-financial assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. The Company accounts for no instruments at fair value using level 3 valuation.

ASC 825-10 “Financial Instruments”, allows entities to voluntarily choose to measure certain financial assets and liabilities at fair value (fair value option). The fair value option may be elected on an instrument-by-instrument basis and is irrevocable, unless a new election date occurs. If the fair value option is elected for an instrument, unrealized gains and losses for that instrument should be reported in earnings at each subsequent reporting date. The Company did not elect to apply the fair value option to any outstanding instruments.

Cash and Cash Equivalents

For purposes of the consolidated statements of cash flows, the Company considers all highly liquid instruments with a maturity of three months or less at the purchase date and money market accounts to be cash equivalents.

Accounts Receivable

Accounts receivable are presented net of an allowance for doubtful accounts. The Company maintains an allowance for doubtful accounts for estimated losses. The Company reviews the accounts receivable on a periodic basis and makes general and specific allowance when there is doubt as to the collectability of individual balances. In evaluating the collectability of individual receivable balance, the Company considers many factors, including the age of the balance, a customer’s historical payment history, its current credit-worthiness and current economic trends. Accounts are written off after exhaustive efforts at collection. The Company only grants credit terms to established customers who are deemed to be financially responsible. The expense associated with the allowance for doubtful accounts is recognized as general and administrative expense.

Inventory

Inventory is stated at the lower of cost or net realizable value. Cost is determined using the first-in, first-out (FIFO) method based on prices paid for inventory items. This valuation requires us to make judgments, based on currently available information, about the likely method of disposition, such as sales to individual customers and expected recoverable values.

| F-7 |

Property and Equipment

Property and equipment are stated at cost and are depreciated using the straight-line method over their estimated useful lives, which range from three to ten years. Leasehold improvements are depreciated over the shorter of the useful life or lease term including scheduled renewal terms. Maintenance and repairs are charged to expense as incurred. When assets are retired or disposed of, the cost and accumulated depreciation are removed from the accounts, and any resulting gains or losses are included in income in the year of disposition. The Company examines the possibility of decreases in the value of these assets when events or changes in circumstances reflect the fact that their recorded value may not be recoverable.

Impairment of Long-Lived Assets

In accordance with ASC Topic 360, the Company reviews long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets may not be fully recoverable, or at least annually. The Company recognizes an impairment loss when the sum of expected undiscounted future cash flows is less than the carrying amount of the asset. The amount of impairment is measured as the difference between the asset’s estimated fair value and its book value. The Company did not record any impairment charge for the three and six months ended June 30, 2020 and 2019.

Revenue Recognition

We adopted ASC Topic 606, Revenue from Contracts with Customers (“ASC Topic 606”), effective January 1, 2018 using the modified retrospective method. ASC Topic 606 is a comprehensive revenue recognition model that requires revenue to be recognized when control of the promised goods or services are transferred to our customers at an amount that reflects the consideration that we expect to receive. The application of ASC Topic 606 requires us to use significant judgment and estimates. Application of ASC Topic 606 requires a five-step model applicable to all revenue streams as follows:

Identification of the contract, or contracts, with a customer

A contract with a customer exists when (i) we enter into an enforceable contract with a customer that defines each party’s rights regarding the goods or services to be transferred and identifies the payment terms related to these goods or services, (ii) the contract has commercial substance and, (iii) we determine that collection of substantially all consideration for goods or services that are transferred is probable based on the customer’s intent and ability to pay the promised consideration. We apply judgment in determining the customer’s ability and intention to pay, which is based on a variety of factors including the customer’s historical payment experience or, in the case of a new customer, published credit and financial information pertaining to the customer.

Identification of the performance obligations in the contract

Performance obligations promised in a contract are identified based on the goods or services that will be transferred to the customer that are both capable of being distinct, whereby the customer can benefit from the goods or service either on its own or together with other resources that are readily available from third parties or from us, and are distinct in the context of the contract, whereby the transfer of the goods or services is separately identifiable from other promises in the contract.

When a contract includes multiple promised goods or services, we apply judgment to determine whether the promised goods or services are capable of being distinct and are distinct within the context of the contract. If these criteria are not met, the promised goods or services are accounted for as a combined performance obligation.

Determination of the transaction price

The transaction price is determined based on the consideration to which we will be entitled to receive in exchange for transferring goods or services to our customer. We estimate any variable consideration included in the transaction price using the expected value method that requires the use of significant estimates for discounts, cancellation periods, refunds and returns. Variable consideration is described in detail below.

| F-8 |

Allocation of the transaction price to the performance obligations in the contract

If the contract contains a single performance obligation, the entire transaction price is allocated to the single performance obligation. Contracts that contain multiple performance obligations require an allocation of the transaction price to each performance obligation based on a relative Stand-Alone Selling Price (“SSP,”) basis. We determine SSP based on the price at which the performance obligation would be sold separately. If the SSP is not observable, we estimate the SSP based on available information, including market conditions and any applicable internally approved pricing guidelines.

Recognition of revenue when, or as, we satisfy a performance obligation

We recognize contract revenue over time and product revenue at a point in time, when the related performance obligation is satisfied by transferring the promised goods or services to our customer. Contract revenue is recognized based on a cost-to-cost input method.

Disaggregation of Revenue

For the three and six months ended June 30, 2020, total sales in the United States represented approximately 70% and 74% of total consolidated revenues. For the same periods in 2019, sales in the United States represented approximately 95% and 91% of total consolidated revenues. Sales to Germany represented 22% and 16% of consolidated revenues in the three and six months ended June 30, 2020. No other geographical area accounted for more than 10% of total sales during the three and six months ended June 30, 2020 and 2019.

Principal versus Agent Considerations

When another party is involved in providing goods or services to our customer, we apply the principal versus agent guidance in ASC Topic 606 to determine if we are the principal or an agent to the transaction. When we control the specified goods or services before they are transferred to our customer, we report revenue gross, as principal. If we do not control the goods or services before they are transferred to our customer, revenue is reported net of the fees paid to the other party, as agent. Our evaluation to determine if we control the goods or services within ASC Topic 606 includes the following indicators:

We are primarily responsible for fulfilling the promise to provide the specified good or service.

When we are primarily responsible for providing the goods and services, such as when the other party is acting on our behalf, we have indication that we are the principal to the transaction. We consider if we may terminate our relationship with the other party at any time without penalty or without permission from our customer.

We have inventory risk before the specified good or service has been transferred to a customer or after transfer of control to the customer.

We may commit to obtaining the services of another party with or without an existing contract with our customer. In these situations, we have risk of loss as principal for any amount due to the other party regardless of the amount(s) we earn as revenue from our customer.

The entity has discretion in establishing the price for the specified good or service.

We have discretion in establishing the price our customer pays for the specified goods or services.

Contract Assets

We capitalize costs and estimated earnings in excess of billings as a contract asset in current assets. At June 30, 2020 and 2019, contract assets totaled $34,589 and $14,265, respectively.

| F-9 |

Contract Liabilities

Contract liabilities consist of customer advance payments and billings in excess of revenue recognized. We may receive payments from our customers in advance of completing our performance obligations. We record contract liabilities equal to the amount of payments received in excess of revenue recognized, Contract liabilities are recorded under the caption “contract liabilities” and are reported as current liabilities on our consolidated financial statements when the time to fulfill the performance obligations under terms of our contracts is less than one year. At June 30, 2020 and 2019, contract liabilities totaled $0 and $95,015, respectively.

Cost of Sales

Cost of sales includes inventory costs, materials and supplies costs, internal labor and related benefits, subcontractor costs, depreciation, overhead and shipping and handling costs incurred.

Shipping and Handling Costs

Shipping and handling costs incurred relating to the purchase of inventory are included in inventory which is charged to cost of sales as products are sold. Shipping and handling costs incurred for product shipped to customers are included in cost of sales. For the three months ended June 30, 2020 and 2019 shipping and handling costs amounted to $13,416 and $29,507, respectively, and $51,027 and $46,028 for the six months ended June 30, 2020 and 2019, respectively.

Research and Development

Research and development costs incurred in the development of the Company’s products and under other Company sponsored research and development projects are expensed as incurred. Costs such as direct labor, direct costs, and other allocated costs incurred to perform research and development service pursuant to government and private research projects are in included in cost of sales. Research and development costs incurred in the development of the Company’s products for the three months ended June 30, 2020 and 2019 were $14,383 and $41,024, respectively, and were $31,035 and $56,829 for the six months ended June 30, 2020 and 2019, respectively, and are included in operating expenses on the accompanying unaudited consolidated statements of operations.

Advertising Costs

The Company participates in various advertising programs. All costs related to advertising of the Company’s products are expensed in the period incurred. Advertising costs charged to operations for the three months ended June 30, 2020 and 2019 were $0 and $1,834, respectively, and were $2,594 and $1,980 for the six months ended June 30, 2020 and 2019, respectively, and are included in sales and marketing on the unaudited consolidated accompanying statements of operations. These advertising expenses do not in include cooperative advertising and sales incentives which have been deducted from sales.

Federal and State Income Taxes

The Company accounts for income tax using the liability method prescribed by ASC 740, “Income Taxes”. Under this method, deferred tax assets and liabilities are determined based on the difference between the financial reporting and tax bases of assets and liabilities using enacted tax rates that will be in effect in the year in which the differences are expected to reverse. The Company records a valuation allowance to offset deferred tax assets if based on the weight of available evidence, it is more-likely-than-not that some portion, or all, of the deferred tax assets will not be realized. The effect on deferred taxes of a change in tax rates is recognized as income or loss in the period that includes the enactment date.

The Company follows the accounting guidance for uncertainty in income taxes using the provisions of ASC 740 “Income Taxes”. Using that guidance, tax positions initially need to be recognized in the financial statements when it is more likely than not the position will be sustained upon examination by the tax authorities. As of June 30, 2020, and December 31, 2019, the Company had no uncertain tax positions that qualify for either recognition or disclosure in the financial statements. Tax years that remain subject to examination are the years ending on and after December 31, 2017. The Company does not expect any significant changes in its unrecognized tax benefits within twelve months of the reporting date. The Company recognizes interest and penalties related to uncertain income tax positions in other expense. However, no such interest and penalties were recorded as of June 30, 2020 or December 31, 2019.

| F-10 |

Stock-Based Compensation

Stock-based compensation is accounted for based on the requirements of the Share-Based Payment Topic of ASC 718 which requires recognition in the financial statements of the cost of employee and director services received in exchange for an award of equity instruments over the period the employee or director is required to perform the services in exchange for the award (presumptively, the vesting period). The ASC also requires measurement of the cost of employee and director services received in exchange for an award based on the grant-date fair value of the award. The Company adopted ASU No. 2017-09 in 2018; its adoption did not have a material impact on its consolidated financial statements.

Pursuant to ASC Topic 505-50, for share-based payments to consultants and other third-parties, compensation expense is determined at the “measurement date.” The expense is recognized over the service period of the award. Until the measurement date is reached, the total amount of compensation expense remains uncertain. The Company initially records compensation expense based on the fair value of the award at the reporting date.

Loss Per Share of Common Stock

ASC 260 “Earnings Per Share”, requires dual presentation of basic and diluted earnings per share (“EPS”) with a reconciliation of the numerator and denominator of the basic EPS computation to the numerator and denominator of the diluted EPS computation. Basic EPS excludes dilution. Diluted EPS reflects the potential dilution that could occur if securities or other contracts to issue common stock were exercised or converted into common stock or resulted in the issuance of common stock that then shared in the earnings of the entity. Basic net loss per common share is computed by dividing net loss available to common shareholders by the weighted average number of shares of common shares outstanding during the period. Diluted net loss per common share is computed by dividing net loss by the weighted average number of shares of common stock, common stock equivalents and potentially dilutive securities outstanding during each period. Potentially dilutive common shares consist of common stock options and warrants (using the treasury stock method).

These common stock equivalents may be dilutive in the future. Potentially dilutive common shares were excluded from the computation of diluted shares outstanding as they would have an anti-dilutive impact on the Company’s net losses and consisted of the following:

| June 30, 2020 | December 31, 2019 | |||||||

| Stock options | 554,719 | 455,502 | ||||||

| Stock warrants | 4,462,715 | 2,817,463 | ||||||

| Total | 5,017,434 | 3,272,965 | ||||||

Net loss per share for each class of common stock is as follows:

| Net (loss) income per common shares outstanding: | Three Months ended June 30, 2020 | Three Months ended June 30, 2019 | Six Months ended June 30, 2020 | Six Months ended June 30, 2019 | ||||||||||||

| Class A common stock | $ | (0.04 | ) | $ | (0.09 | ) | $ | (0.10 | ) | $ | (0.11 | ) | ||||

Weighted average shares outstanding: | ||||||||||||||||

| Class A common stock | 7,199,942 | 4,472,389 | 6,850,643 | 4,312,554 | ||||||||||||

| Total weighted average shares outstanding | 7,199,942 | 4,472,389 | 6,850,643 | 4, 312,554 | ||||||||||||

| F-11 |

Segment Reporting

The Company uses “the management approach” in determining reportable operating segments. The management approach considers the internal organization and reporting used by the Company’s chief operating decision maker for making operating decisions and assessing performance as the source for determining the Company’s reportable segments. The Company’s chief operating decision maker is the President of the Company, who reviews operating results to make decisions about allocating resources and assessing performance for the entire Company. The Company classified the reportable operating segments into (i) the development, manufacture and sale of consumer and institutional products using nanotechnology to deliver unique performance attributes at the surfaces of a wide variety of substrates (the “Product segment”) and (ii) nanotechnology design and development services for our future products and for government and private entities (the “Contract services segment”).

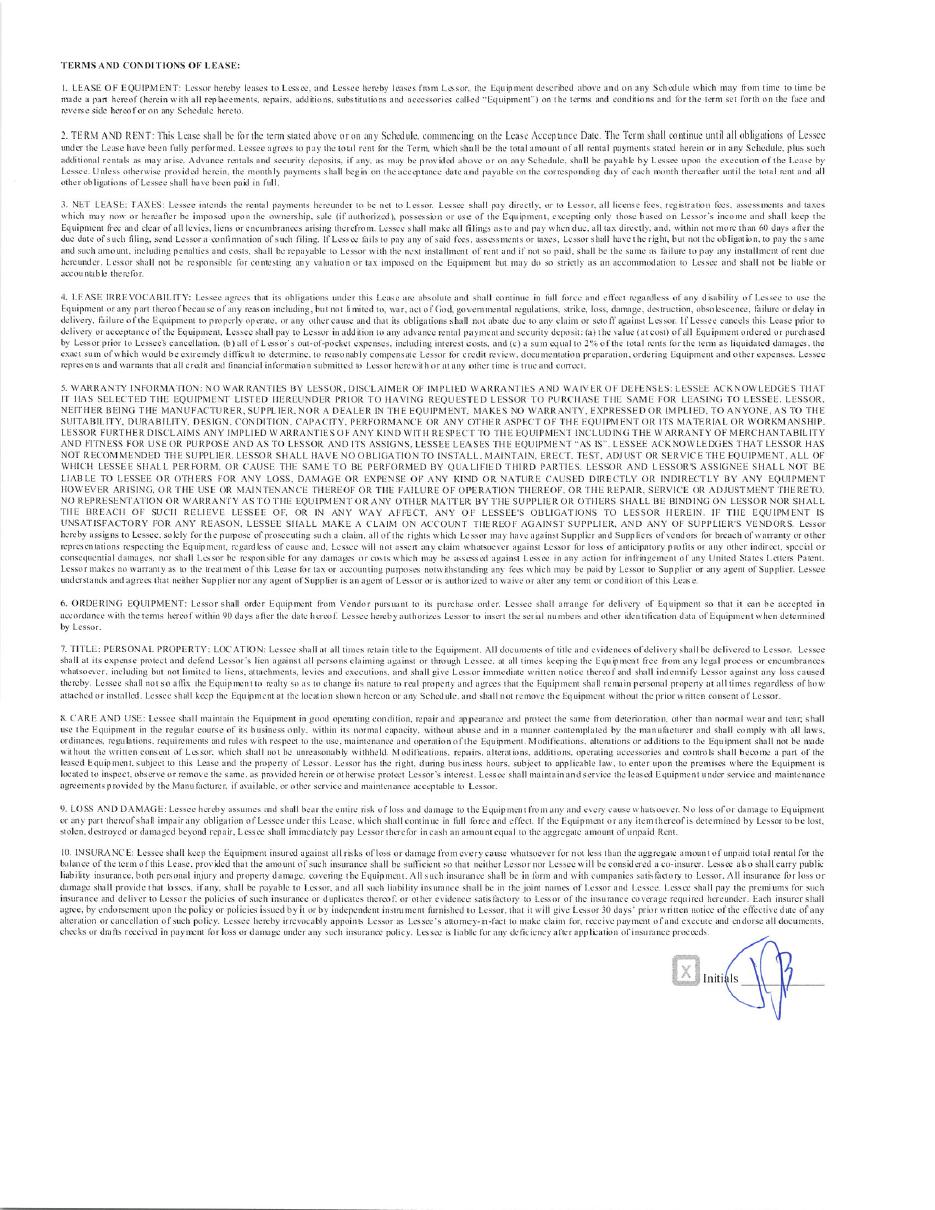

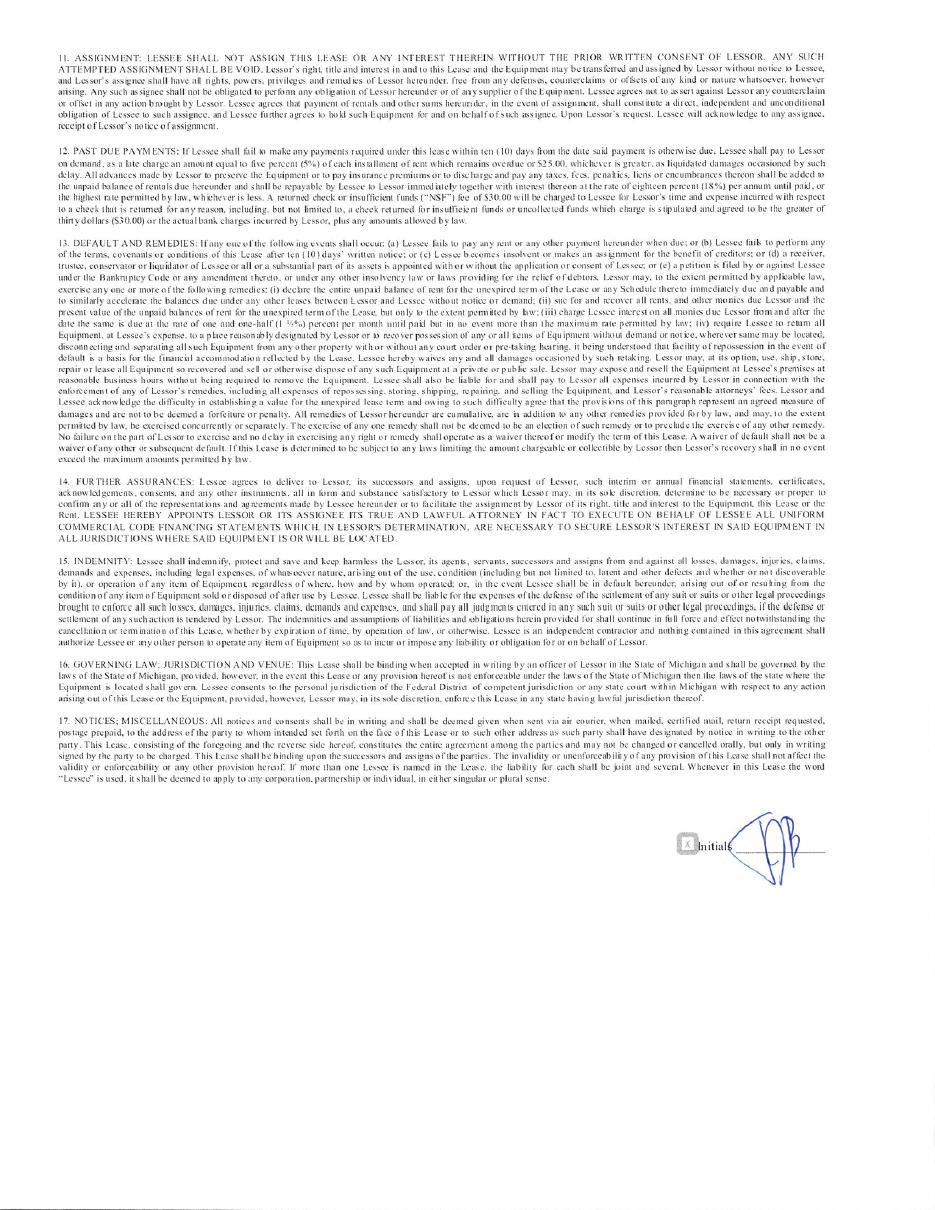

Leases

The Company adopted ASC 842 on January 1, 2019 using the modified retrospective basis and did not adjust comparative periods as permitted under Accounting Standards Update (“ASU”) 2018-11. ASC 842 supersedes nearly all existing lease accounting guidance under U.S. GAAP issued by the Financial Accounting Standards Board (“FASB”) including ASC Topic 840, Leases. ASC 842 requires that lessees recognize Right-of-Use (ROU) assets and lease liabilities calculated based on the present value of lease payments for all lease agreements with terms that are greater than twelve months. ASC 842 distinguishes leases as either a finance lease or an operating lease that affects how the leases are measured and presented in the statement of operations and statement of cash flows.

For operating leases, we calculated ROU assets and lease liabilities based on the present value of the remaining lease payments as of the date of adoption using the IBR as of that date. On the date of adoption, operating lease liabilities and right-of-use assets totaled $400,327. We do not have finance leases as per the definition of ASC 842 as of June 30, 2019.

The FASB issued practical expedients and accounting policy elections that the Company has applied as described below.

Practical Expedients

ASC 842 provides a package of three practical expedients that must be adopted together and applied to all lease agreements. The Company elected the package of practical expedients as follows for all leases:

Whether expired or existing contracts contain leases under the new definition of a lease.

Because the accounting for operating leases and service contracts was similar under ASC 840, there was no accounting reason to separate lease agreements from service contracts in order to account for them correctly. The Company reviewed existing service contracts to determine if the agreement contained an embedded lease to be accounted for on the balance sheet under ASC 842.

Lease classification for expired or existing leases.

Leases that were capital leases under ASC 840 are accounted for as financing leases under ASC 842 while leases that were operating leases under ASC 840 are accounted for as operating leases under ASC 842.

Whether previously capitalized initial direct costs would meet the definition of initial direct costs under the new standard guidance.

The definition of initial direct costs is more restrictive under ASC 842 than under ASC 840. Entities that do not elect the practical expedient are required to reassess capitalized initial direct costs under ASC 840 and record an equity adjustment for those that are not capitalizable under ASC 842.

| F-12 |

Accounting Policy Elections

Lease Term

The Company calculates the term for each lease agreement to include the noncancelable period specified in the agreement together with (1) the periods covered by options to extend the lease if the Company is reasonably certain to exercise that option, (2) periods covered by an option to terminate if the Company is reasonably certain not to exercise that option and (3) period covered by an option to extend (or not terminate) if controlled by the lessor.

The assessment of whether the Company is reasonably certain to exercise an option to extend a lease requires significant judgement surrounding contract-based factors, asset-based factors, entity-based factors and market-based factors.

Lease Payments

Lease payments consist of the following payments (as applicable) related to the use of the underlying asset during the lease term:

| ● | Fixed payments, including in substance fixed payments, less any lease incentives paid or payable to the lessee | |

| ● | Variable lease payments that depend on an index or a rate, such as the Consumer Price Index or a market interest rate, initially measured using the index or rate at the commencement date of January 1, 2019. | |

| ● | The exercise price of an option to purchase the underlying asset if the lessee is reasonably certain to exercise that option. | |

| ● | Payments for penalties for terminating the lease if the lease term reflects the lessee exercising an option to terminate the lease. | |

| ● | Fees paid by the lessee to the owners of a special-purpose entity for structuring the transaction | |

| ● | For a lessee only, amounts probable of being owed by the lessee under residual value guarantees |

Incremental Borrowing Rate

The ROU asset and related lease liabilities recorded under ASC 842 are calculated based on the present value of the lease payments using (1) the rate implicit in the lease or (2) the lessee’s IBR, defined as the rate of interest that a lessee would have to pay to borrow on a collateralized basis over a similar term an amount equal to the lease payments in a similar economic environment.

Recently Issued Accounting Pronouncements

Financial Instruments — Credit Losses (Topic 326)

In June 2016, the FASB issued ASU 2016-13, Financial Instruments — Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (“ASU 2016-13”). This standard prescribes an impairment model (known as the current expected credit loss (“CECL”) model) that is based on expected losses rather than incurred losses. Under the new guidance, an entity recognizes as an allowance its estimate of expected credit losses, which is intended to result in the timely recognition of losses. Under the CECL model, entities will estimate credit losses over the entire contractual term of the instrument from the date of initial recognition of the financial instrument.

Measurement of expected credit losses is to be based on relevant forecasts that affect collectability. The scope of financial assets within the CECL methodology is broad and includes trade receivables from certain revenue transactions and certain off-balance sheet credit exposures. Different components of the guidance require modified retrospective or prospective adoption. ASU 2016-13 is effective for the annual reporting period beginning on or after December 15, 2020. The Company adopted this standard January 1, 2020 and there was no material impact.

Except for our accounting policies for allowance for doubtful accounts as a result of adopting ASU 2016-13, there have been no changes to our significant accounting policies described in Note 2 to our Annual Report on Form 10-K for the year ended December 31, 2019, that have had a material impact on our Consolidated Financial Statements and related notes.

| F-13 |

Reclassifications

Certain accounts and financial statement captions in the prior periods have been reclassified to conform to the current period financial statements.

NOTE 3 – CORRECTION OF IMMATERIAL ERRORS

During the fourth quarter of 2019, the Company identified errors in accounting for revenues and cost of revenues resulting in immaterial correction of errors in previously issued consolidated financial statements. Each of these errors affected periods beginning prior to 2018 through December 31, 2019. In accordance with Staff Accounting Bulletin (SAB) No. 99, Materiality, and SAB No. 108, Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements, management evaluated the materiality of the errors from qualitative and quantitative perspectives, and concluded that while the errors did not, individually, or in the aggregate, result in a material misstatement of the previously issued consolidated financial statements, correcting these errors in the fourth quarter ended December 31, 2019 would have been material to that quarter.

The adjustments cumulatively impacted the following balances for the six months ended June 30, 2019:

| As Reported | Adjustment | As Corrected | ||||||||||

Product revenues |

$ | 825,315 | $ | 47,385 | a | $ | 872,700 | |||||

| Contract revenues | 584,185 |

(77,036 |

)b |

507,149 |

||||||||

| Cost of product revenues | 557,021 | 31,875 | c | 588,896 | ||||||||

| Cost of contract revenues | 622,353 |

(91,082 |

)d |

531,271 |

||||||||

| Gross profit | 230,126 | 29,556 |

e | 259,682 | ||||||||

| Operating expenses | 677,797 | 41,697 | f | 719,494 | ||||||||

| Other income (expense) | 56,523 | (59,207 | )d | (2,684 | ) | |||||||

| Net (loss) | (391,148 | ) | (71,348 | )g | (462,496 | ) | ||||||

Net (loss) per common share |

$ | (0.09 |

) | $ | (0.02 | )h | $ | (0.11 | ) | |||

References to above adjustments

| a. | This accounts for a reclassification of $47,385 in revenues from contract revenues to product revenues booked on the Company’s wholly-owned subsidiary, Applied Nanotech, Inc., |

| b. | With the proper recognition of contract services revenues with the adoption of ASC Topic 606, in-progress contract revenue was determined to be overstated in the second quarter of 2019 by $29,651. This, along with the reclassification in point (a) above, comprises the total adjustment of $77,036. |

| c. | This accounts for the reclassification $31,875 from cost of contract revenues to cost of product revenues in line with the reclassification of segmented revenues in point (a) above. |

| d. | This accounts for the reclassification of sublease income totaling $59,207 for the six months ending June 30, 2019 from other income to cost of contract revenues, plus $31,875 in cost of contact revenues reclassified to cost of product revenues as per point (c) above. |

| e. | This accounts for the net impact of the reclassification of sublease income of $59,207 in point (d) above, offset by the overstatement of contract services revenues of $29,651 outlined in point (b) above. |

| f. | The $41,697 adjustment represents $19,697 booked for compensation expense from options granted to an executive in the second quarter of 2019 plus $22,000 for the accrual of audit fees performed in the first quarter of 2019 not previously recorded in the period. |

| g. | Net loss was understated by $71,348 for the six months ending June 30, 2019, due to $29,651 in overstated contract services revenues outlined in point (b) above plus $41,697 in understated expenses outlined in point (f) above. |

| h. | Net (loss) per common share for the six months ended June 30, 2019 resulting from the adjustments as outlined above has been corrected to $0.11 per share from the previously reported number of $0.09 per share. |

NOTE 4 – ACCOUNTS RECEIVABLE

At June 30, 2020 and December 31, 2019, accounts receivable consisted of the following:

| June 30, 2020 | December 31, 2019 | |||||||

| Accounts receivable | $ | 542,141 | $ | 164,960 | ||||

| Less: allowance for doubtful accounts | (13,670 | ) | (13,670 | ) | ||||

| Accounts receivable, net | $ | 528,471 | $ | 151,290 | ||||

NOTE 5 – INVENTORY

At June 30, 2020 and December 31, 2019, inventory consisted of the following:

| June 30, 2020 | December 31, 2019 | |||||||

| Raw materials | $ | 666,175 | $ | 663,932 | ||||

| Work-in-progress | - | - | ||||||

| Finished goods | 341,041 | 335,762 | ||||||

$ | 1,007,216 | $ | 999,694 | |||||

| Less: reserve for obsolescence | (663,193 | ) | (577,072 | ) | ||||

| Inventory, net | $ | 344,023 | $ | 422,622 | ||||

| F-14 |

NOTE 6 - PROPERTY AND EQUIPMENT

Property and equipment are stated at cost and are depreciated using the straight-line method over their estimated useful lives, which range from three to ten years. Leasehold improvements are depreciated over the shorter of the useful life or lease term including scheduled renewal terms. Maintenance and repairs are charged to expense as incurred. When assets are retired or disposed of, the cost and accumulated depreciation are removed from the accounts, and any resulting gains or losses are included in other income or expense in the year of disposition. The Company examines the possibility of decreases in the value of these assets when events or changes in circumstances reflect the fact that their recorded value may not be recoverable.

NOTE 7 – OPERATING LEASE RIGHT-OF-USE ASSETS

Leasing Transactions

The Company’s leased assets include offices, production and research and development facilities. Our current lease portfolio has remaining terms from less than one-year up to seven years. Many of these leases contain options under which we can extend the term for several years. Renewal options are excluded from our calculation of lease liabilities unless we are reasonably assured to exercise the renewal option. Our lease agreements do not contain residual value guarantees or material restrictive covenants.

On September 20, 2017, the Company entered into a three-year lease agreement for 26,063 square feet of office space in Brooklyn Heights, Ohio beginning September 20, 2017 and ending September 20, 2020. Monthly lease payments amount to $8,688.

On December 10, 2018, we entered into a five-year lease agreement for 3,742 square feet of space for the design facility in Austin, beginning January 2019 and ending February 29, 2024. Monthly lease payments start at $3,472 per month, increasing 3% each year.

On June 21, 2019, we leased approximately 1,200 square feet of office space in Bingham Farms, Michigan for nine months for a sales office. Monthly payments are $1,529 per month. The lease has been extended through December 31, 2020.

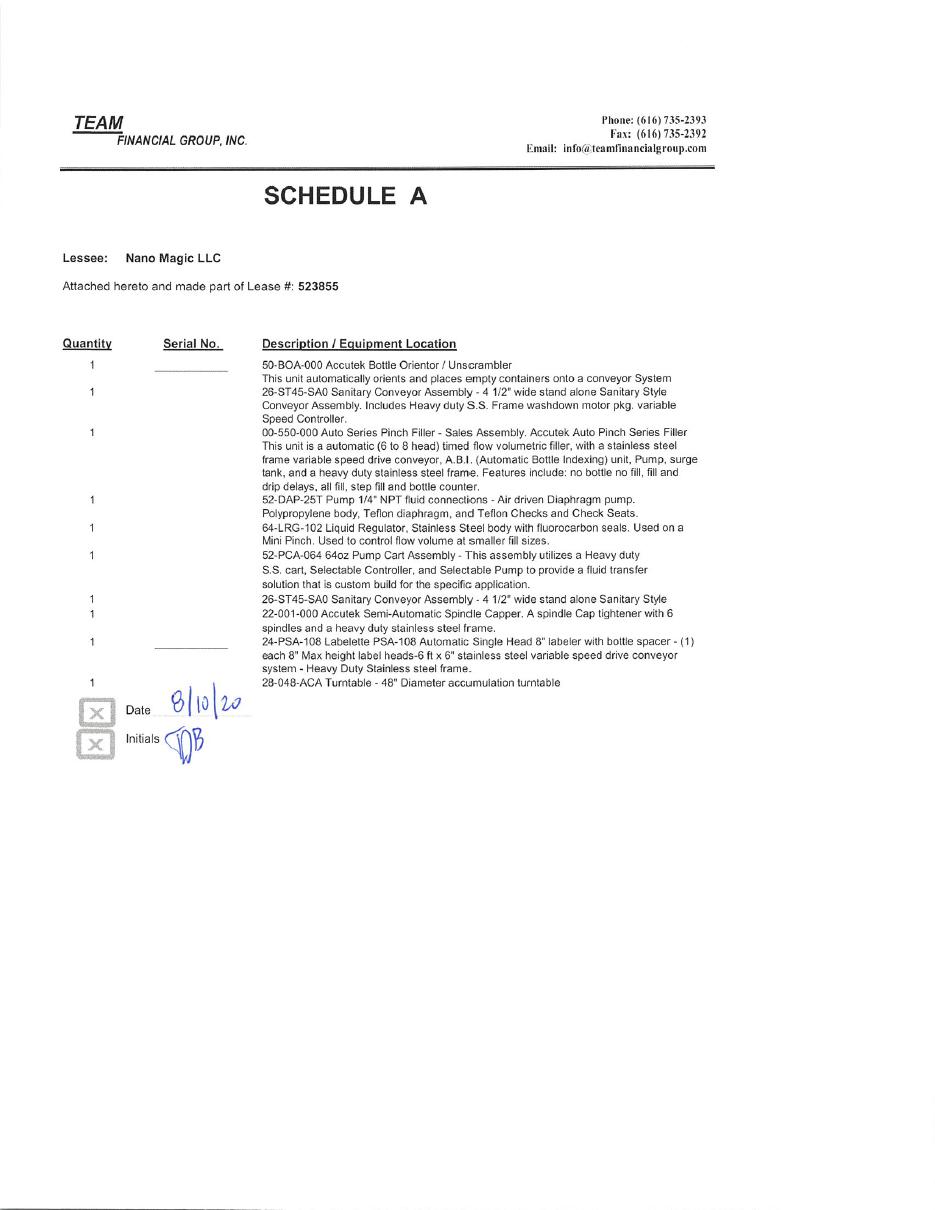

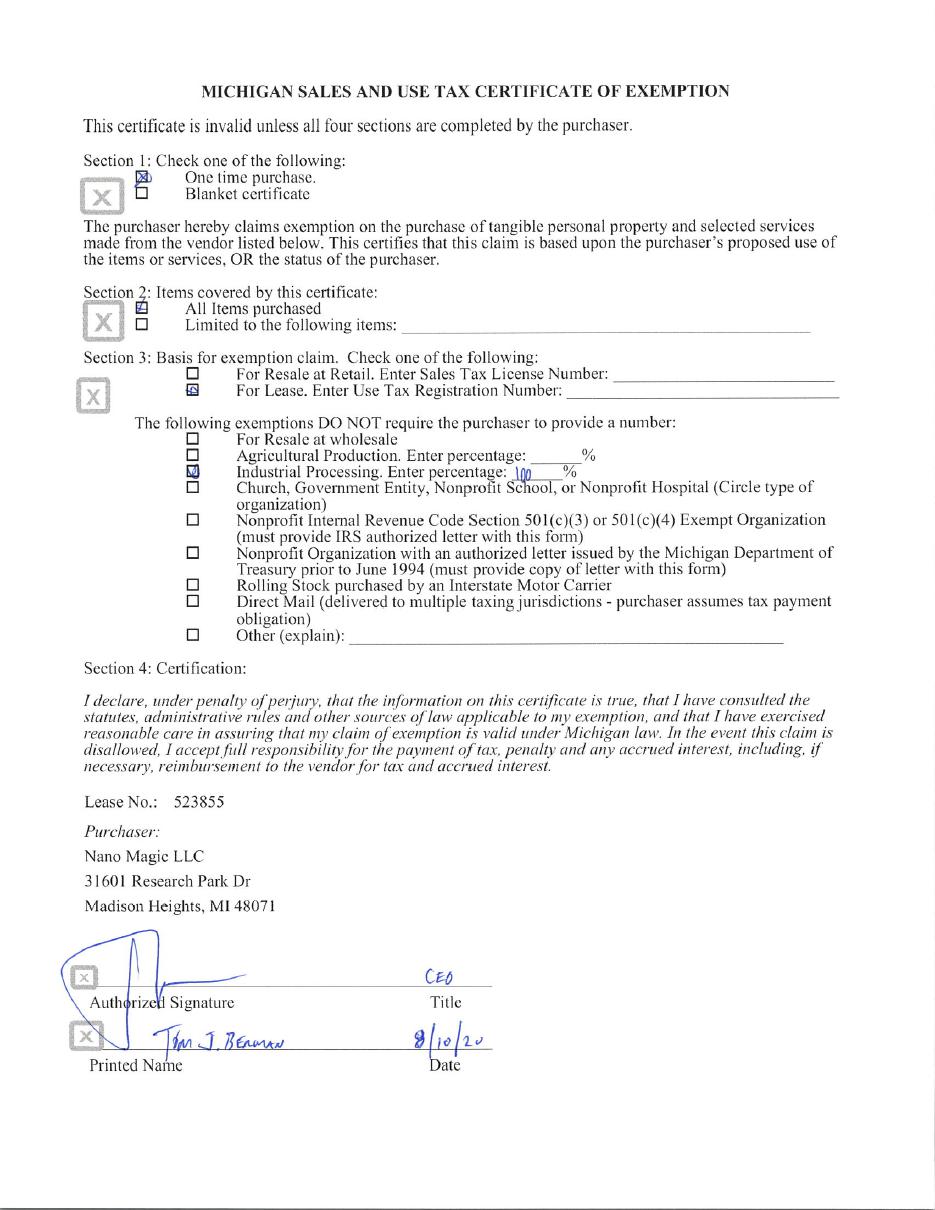

Effective May 31, 2020, we entered into a lease for a 29,220 square foot building in Madison Heights, Michigan. The occupancy date and rent commencement date is October 1, 2020. By that date, the landlord, Magic Research LLC, is required to have completed tenant improvements to accommodate our office and manufacturing needs. When we are established in the new facility, we expect to vacate our facility in Brooklyn Heights, Ohio as our lease there expires in September 2020. The new lease has a term of seven years with a renewal option at the end of the initial term for an additional 3-year term, and a second renewal option thereafter for an additional 5-year term. As the sole tenant, we are responsible for all taxes, ordinary maintenance, snow removal and other ordinary operating expenses. Rent is $6.50 per square foot, increasing by $0.25 per year. During the first three years we also have the right to buy up to a 49% interest in Magic Research LLC for a price equal to 49% of the contributions received from other members. See Note 10, Stockholders’ Equity, for a description of the warrants issued to the landlord in connection with this lease. The fair value of these warrants totaling $311,718 were recorded as initial direct costs of obtaining the lease and are included in other assets on the accompanying balance sheet. See Note 9, Related Party Transactions, for information about Tom J. Berman and Ronald J. Berman’s role in management and economic participation in the landlord.

Operating leases are reflected on our balance sheet within operating lease ROU assets and the related current and non-current operating lease liabilities. Leases with terms of less than twelve months have been classified as current ROU assets, whereas the lease with a remaining term of more than twelve months has been classified as a non-current ROU asset. ROU assets represent the right to use an underlying asset for the lease term, and lease liabilities represent the obligation to make lease payments arising from lease agreement. Operating lease ROU assets and liabilities are recognized at the commencement date, or the date on which the lessor makes the underlying asset available for use, based upon the present value of the lease payments over the respective lease term. Lease expense is recognized on a straight-line basis over the lease term, subject to any changes in the lease or expectation regarding the terms. Variable lease costs such as common area maintenance, property taxes and insurance are expensed as incurred.

| F-15 |

Balance Sheet

Supplemental balance sheet information related to leases was as follows:

| June 30, 2020 | December 31, 2019 | |||||||

| Operating Leases | ||||||||

| Total operating lease ROU assets | $ | 181,755 | $ | 257,523 | ||||

| Operating lease liabilities (current) | 74,449 | 131,835 | ||||||

| Operating lease liabilities (noncurrent) | 118,320 | 136,624 | ||||||

| Total operating lease liabilities | $ | 192,769 | $ | 268,459 | ||||

The average remaining lease term in months is 18.7 months with an average discount rate of 8.5%.

Income Statement

Supplemental income statement information related to leases was as follows:

| June 30, 2020 | June 30, 2019 | |||||||

| Operating Lease Costs | ||||||||

| Cost of product revenue | $ | 62,282 | $ | 62,282 | ||||

| Cost of contract services | 23,170 | 23,170 | ||||||

| Variable lease costs | 21,910 | 34,811 | ||||||

| Sublease income | (27,000 | ) | (59,207 | ) | ||||

| Net operating lease cost | $ | 80,363 | $ | 61,056 | ||||

NOTE 8 – NOTES PAYABLE

On February 10, 2015, Nano Magic LLC (then named Nanofilm) entered into a promissory note (the “Equipment Note”) with KeyBank, N.A. (the “Bank”) to borrow up to $373,000. Nanofilm may obtain one or more advances not to exceed $373,000. The unpaid principal balance of this Equipment Note is payable in 60 equal monthly installments payments of principal and interest through June 10, 2020. The Equipment Note is secured by certain equipment, as defined in the Equipment Note, and bears interest computed at a rate of interest of 4.35% per annum based on a year of 360 days. At December 31, 2019, the principal amount due under the Equipment Note amounted to $115,926. Due to the slowdown caused by the COVID-19 pandemic, KeyBank agreed in April 2020 that we would not be required to make scheduled payments in April, May and June. The amount that would have been paid will be added to the final scheduled loan payment. As of June 30, 2020, $44,333 and $61,218, represent the current and non-current portion due under this note.

In June and November 2015, in connection with a severance package offered to four employees, the Company entered into four promissory note agreements with the four employees which obligate the Company to pay these employees accrued and unpaid deferred salary in an aggregate amount of $51,808. The principal amounts due under these notes shall bear interest at the minimum rate of interest applicable under the internal revenue code (approximately 3.0% at December 31, 2019). As of June 30, 2020, principal and interest payable under three of these notes aggregating $37,458 are due in 2025 and are included in non-current notes payable.

January 2017, the Company issued a promissory note in the principal amount of $17,425 to a departing employee representing the amount of his accrued and unpaid salary. The note does not bear interest and is due in January 2027, and is included in non-current notes payable.

| F-16 |

On May 8, 2020, we obtained a loan from Fifth Third Bank for $130,900 under the Small Business Administration Paycheck Protection Program. The loan bears interest at 1.00% and is payable in monthly installments of principal and interest in the amount of $7,330 beginning in December, 2020.

NOTE 9 – RELATED PARTY TRANSACTIONS

Apart from Board fees paid to all of our directors, we paid the following amounts as compensation to our directors:

| Three Months ended June 30, | Six Months ended June 30, | |||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||

| Ronald J. Berman | $ | 47,700 | 22,625 | 139,700 | 35,385 | |||||||||||

| Tom J. Berman | $ | 45,000 | * | 22,500 | 92,000 | * | 120,964 | + | ||||||||

| Jeanne M Rickert | $ | 3,000 | 3,000 | * | 6,000 | 6,000 | * | |||||||||

| Scott E. Rickert | $ | 3,000 | 3,000 | * | 6,000 | 6,000 | * | |||||||||

*Indicates amount paid as salary

+ $57,177 of this total was paid as salary starting in April, 2019.

Ron Berman and Tom Berman each have a 2.08% ownership interest in Magic Research LLC, the landlord for the facility we leased in Michigan effective May 31, 2020. The manager of Magic Research LLC is Magic Research Management LLC; Ron Berman and Tom Berman are two of its three co-managers. Compensation from Magic Research LLC to Magic Research Management LLC is $10,000 per year to oversee the recordkeeping, tax return preparation, oversight of tenant improvements and other operating costs for the landlord.

Ron Berman and Tom Berman share ownership of PEN Comeback Management, LLC that is the sole voting member of PEN Comeback, LLC, PEN Comeback 2, LLC and Magic Growth, LLC.

NOTE 10 - STOCKHOLDERS’ EQUITY

Description of Preferred and Common Stock

On December 11, 2015, the Board of Directors of the Company approved a reverse stock split of the issued and outstanding shares of the Company’s common stock at the ratio of 1-for-180 (the “Reverse Stock Split”) and authorized an amendment of the Company’s Amended and Restated Certificate of Incorporation, as amended, to effect the Reverse Stock Split, to reduce the number of authorized shares of common stock, and to set a par value of $0.0001 per share after the Reverse Stock Split. On January 26, 2016, each one hundred eighty (180) shares of the Company’s (i) Class A Common Stock (“Class A common stock”), (iii) Class B Common Stock and (iii) Class Z Common Stock, then issued and outstanding were automatically combined into one (1) validly issued, fully paid and non-assessable share of Class A Common Stock, Class B Common Stock and Class Z Common Stock, respectively, without any further action by the Company or the holder. Additionally, the authorized number of shares of common stock were reduced to 10,000,000 comprised of 7,200,000 shares of Class A Common Stock, 2,500,000 shares of Class B Common Stock (“Class B common stock”), and 300,000 shares of Class Z Common Stock (“Class Z common stock”). The par value of each class of common stock remained the same at $0.0001 per common share. All share and per share data in the accompanying unaudited consolidated financial statements have been retroactively restated to reflect the effect of the Reverse Stock Split and authorized shares. The Company is also authorized to issue 20,000,000 shares of Preferred Stock, par value $0.0001 per share (“preferred stock”).

| F-17 |

The Company has accepted subscriptions and has received payment for 279,283 shares of Class A common stock that have not been issued because the Company lacks sufficient authorized shares to issue the shares and status of shareholder approval to increase the authorized shares of common stock. The same constraint affects outstanding options and warrants; the Company does not have authorized and reserved shares sufficient to issue shares if options or warrants were to be exercised. See Note 15, Subsequent Events, for a description of changes that occurred on July 2, 2020 with respect to the Company’s common stock.

Preferred Stock

The preferred stock may be issued in one or more series. The Company’s board of directors are authorized to issue the shares of preferred stock in such series and to fix from time to time before issuance thereof the number of shares to be included in any such series and the designation, powers, preferences and relative, participating, optional or other rights, and the qualifications, limitations or restrictions thereof, of such series.

Common Stock – General

The rights of each share of Class A common stock, each share of Class B common stock and each share of Class Z common stock are the same with respect to dividends, distributions and rights upon liquidation.

Class A Common Stock

Holders of the Class A common stock are entitled to one vote per share in the election of directors and other matters submitted to a vote of the stockholders.

Class B Common Stock

Conversion Rights. Shares of Class B common stock can be converted, one-for-one, into shares of Class A common stock at any time at the option of the holder. Shares of Class B common stock will automatically be converted into shares of Class A common stock if the shares of Class B common stock are not owned by the Company’s chief executive officer, his spouse, or their descendants and their spouses, or by entities or trusts wholly-owned by them.

Voting Rights Holders of Nano Magic Class B common stock are entitled to 100 votes per share in the election of directors and other matters submitted to a vote of the stockholders.

Class Z Common Stock

Conversion Rights. Shares of Class Z common stock can be converted, one-for-one, into shares of Class A common stock at any time at the option of the holder. Shares of Class Z common stock will automatically be converted into shares of Class A common stock if the shares of Class Z common stock are not owned by Zeiss or an entity wholly owned by the ultimate parent of Zeiss.

Voting Rights. Holders of Nano Magic Class Z common stock do not vote in the election of directors or otherwise, but they do have the right to designate a director to the Nano Magic Board, have anti-dilution rights described below and have consent rights with respect to certain amendments to Nano Magic’s certificate of incorporation.

Other Rights. The Class Z common stock has anti-dilutive rights that, subject to limited exceptions, permit holders of Class Z common stock to purchase additional shares or equity rights issued by Nano Magic (on the same terms as made available to third parties by Nano Magic) to maintain their economic ownership percentage. The holders of Class Z common stock are also entitled to receive a copy of any notice sent to the holders of Class A common stock or Class B common stock, as and when the notice is sent to such holders.

| F-18 |

Issuances of Common Stock

Sales of Common Stock and Derivative Equity Securities

On January 22, 2020, we sold 198,530 shares of Class A common stock in a private placement to PEN Comeback 2 at a per share price of $0.65 for aggregate proceeds of $129,044. At the same time the investor bought 198,516 warrants to purchase up to 198,516 additional shares at a warrant exercise price of $1.50. The right to purchase warrant shares expires four years from date of issue. Aggregate proceeds from the sales of the warrants were $5,955.

On February 24, 2020, we sold 205,883 shares of Class A common stock in a private placement to PEN Comeback 2 at a per share price of $0.65 for aggregate proceeds of $133,824. At the same time the investor bought 205,868 warrants to purchase up to 198,516 additional shares at a warrant exercise price of $1.50. The right to purchase warrant shares expires four years from date of issue. Aggregate proceeds from the sales of the warrants were $6,176.

On March 24, 2020, in a private placement to PEN Comeback 2, we sold 551,600 shares of Class A common stock and committed to issue an additional 242,518 shares when we have additional authorized shares. If the additional shares have not been issued by March 24, 2021, we must refund the purchase price (without interest). Proceeds, at a per share price of $0.65, were $516,177. At the same time the investor bought 794,110 warrants to purchase up to 794,110 additional shares at a warrant exercise price of $1.50. The right to purchase warrant shares expires four years from date of issue. Aggregate proceeds from the sale of the warrants were $23,823.

On March 26, 2020, in a private placement to the same investor we committed to issue 36,765 shares when we have additional authorized shares and accepted $.65 per share for proceeds of $23,897. If the shares have not been issued by March 26, 2021, we must refund the purchase price (without interest). At the same time the investor bought 36,758 warrants to purchase up to 36,780 additional shares at a warrant exercise price of $1.50. The right to purchase warrant shares expires four years from date of issue. Aggregate proceeds from the sale of the warrants were $1,103.

In total for the three and six months ended June 30, 2020, 956,013 shares of Class A common stock were sold and issued for $621,409. Additionally, 1,235,252 warrants were sold for $37,058, and 279,283 shares of Class A common stock were sold for $181,533 but not yet issued and therefore recorded as a subscription payable at June 30, 2020.

Common Stock Issued for Services

On February 12, 2020, we issued an aggregate of 21,048 shares of Class A common stock to our directors as compensation to them for service on our Board. These shares were valued on that date at $0.57 per share based on the quoted price of the stock for a total value of $12,000.

Warrants issued to Landlord

In connection with the lease for the facility in Michigan effective May 31, 2020, we issued the landlord warrants to purchase up to 410,000 shares of our Class A common stock at a warrant exercise price of $1.50 per share. The warrants are exercisable after we have additional authorized shares of stock until the fourth anniversary of the date of the lease. The fair value of the warrants at the date of issuance was $311,718 and were recorded as prepaid, initial direct costs associated with the lease.

| F-19 |

Stock Options

Stock options outstanding are to purchase Class A common stock. Stock options outstanding at June 30, 2020 are 554,859, reflecting a grant of 100,000 under the 2015 Equity Incentive Plan made in the first six months of 2020, and the expiration of 643 options during the same period. No options were exercised during the period.

| Number

of Options |

Weighted Average Exercise Price |

Weighted Average Remaining Contractual Term (Years) |

Aggregate Intrinsic Value |

|||||||||||||

| Balance Outstanding December 31, 2019 | 455,502 | $ | 1.24 | 4.22 | $ | 585,000 | ||||||||||

| Granted | 100,000 | 0.65 | 3.60 | 120,000 | ||||||||||||

| Expired | (643) | 0.51 | ||||||||||||||

| Balance Outstanding June 30, 2020 | 554,859 | $ | 1.06 | 3.71 | $ | 705,000 | ||||||||||

| Exercisable, June 30, 2020 | 129,859 | $ | 2.67 | 3.66 | $ | 162,500 | ||||||||||

Warrants

As of June 30, 2020, there were outstanding and exercisable warrants to purchase 4,462,715 shares of common stock with a weighted average exercise price of $1.50 per share and a weighted average remaining contractual term of 38.19 months. As of June 30, 2020, there was no intrinsic value for exercisable warrants.

Conversion of Class Z Common Stock

On May 23, 2017, Zeiss converted 262,631 shares of Class Z common stock into 262,631 shares of Class A common stock. Immediately thereafter, Zeiss sold 262,631 shares of Class A common stock to certain buyers which included the Company’s Chief Executive Officer for an aggregate of $100,000. In addition, pursuant to the certificate of incorporation, Zeiss’ Board representation automatically terminated and, as a result, Zeiss ceased to be a related party as of May 23, 2017.

Conversion of Class B Common Stock

On or about October 15, 2019 as part of the terms for the stock sale to PEN Comeback, Scott and Jeanne Rickert and their family partnership exercised the right to convert Class B shares into Class A shares on a 1:1 basis resulting in the issuance of 1,436,052 shares of Class A common stock.

2015 Equity Incentive Plan

On November 30, 2015, the Board of Directors authorized the 2015 Equity Incentive Plan (the “Plan”), which reserved 111,111 shares of common stock. If any share of common stock that has been granted pursuant to a stock option ceases to be subject to a stock option, or if any forfeiture or termination affects shares of common stock that are the subject to any other stock-based award, the shares are again available for future grants and awards under the Plan. The Plan’s purpose is to enable the Company to offer its employees, officers, directors and consultants an opportunity to acquire a proprietary interest in the Company for their contributions. On December 31, 2019, we issued an aggregate of 102,500 shares to employees in settlement of accrued salaries totaling $66,615. On January 31, 2020 we granted an option to purchase 100,000 shares to a senior member of the sales team with vesting tied directly to 2020 sales goals.

NOTE 11 - COMMITMENTS AND CONTINGENCIES

Stock Appreciation Rights

If the Company completes an IPO, the value of stock appreciation rights calculated based on the IPO formula may cause a material increase in the value of the liability (See Note 13).

Litigation

The Company may be, from time to time, subject to various administrative, regulatory, and other legal proceedings arising in the ordinary course of business. We are not currently a defendant in any proceedings. Our policy is to accrue costs for contingent liabilities, including legal proceedings or unasserted claims that may result in legal proceedings, when a liability is probable and the amount can be reasonably estimated. As of June 30, 2020, the Company has not accrued any amount for litigation contingencies.

| F-20 |

NOTE 12 – CONCENTRATIONS

Concentrations of Credit Risk

Financial instruments that potentially subject the Company to concentrations of credit risk consist primarily of trade accounts receivable and cash deposits and investments in cash equivalent instruments.

Customer Concentrations

For the six months ended June 30, 2020 and 2019, two customers represented 35% and one different customer represented 15% of product revenues respectively. For the contract revenues segment, three customers accounted for 88% of revenues for the six months ended June 30, 2020 and those same customers accounted for 63% of revenues for the six months ending June 30, 2019.

These customers did not have material accounts receivable balances at June 30, 2020 or 2019. A reduction in sales from or loss of such customers would have a material adverse effect on our results of operations and financial condition.

Geographic Concentrations of Sales

For the three and six months ended June 30, 2020, total sales in the United States represented approximately 70% and 74% of total consolidated revenues. For the same periods in 2019, sales in the United States represented approximately 95% and 91% of total consolidated revenues. Sales to Germany represented 22% and 16% of consolidated revenues in the three and six months ended June 30, 2020. No other geographical area accounted for more than 10% of total sales during the three and six months ended June 30, 2020 and 2019.

Vendor Concentrations

For the six months ended June 30, 2020, two vendors represented 51% of inventory purchases. One of those same vendors represented 49% of inventory purchases for the six months ended June 30, 2019.

NOTE 13 – STOCK APPRECIATION PLAN

From June 1, 1988, until December 31, 1997, when the plan was terminated, Nano Magic LLC had in place a Stock Appreciation Rights Plan A (the “Plan”), intended to provide employees, directors, members of a technical advisory board and certain independent contractors selected by the Board with equity-like participation in the growth of Nano Magic LLC. The maximum number of stock appreciation rights that could be granted by the Board was 1,000,000.