UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 30, 2020

CQENS

Technologies Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

000-55470 |

|

27-1521407 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

5550

Nicollet Avenue, Minneapolis, MN 55419

(Address

of principal executive offices)(Zip Code)

Registrant’s

telephone number, including area code: (612) 812-2037

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

[ ] Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d- 2(b))

[ ] Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c))

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

n/a |

|

n/a |

Indicate

by check mark whether the registrant is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [X]

If

an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section3(a) of the Exchange Act. [ ]

| Item

2.01 | Completion

of Acquisition or Disposition of Assets. |

On

September 30, 2020 CQENS Technologies Inc. (the “Company”) entered into an Asset Purchase Agreement (the “IP

Asset Purchase Agreement”) with Xten Capital Group, Inc., a related party (“Xten”), pursuant to which it acquired

a portfolio of 29 U.S. and international patents and patent applications in the areas of devices and technologies for aerosolizing

certain remedies and pharmaceutical preparations, as well as the solutions and preparation for inhaled delivery. . As consideration

for the acquisition, the Company issued Xten common stock purchase warrants exercisable for an aggregate of 21,000,000 shares

of its common stock at an exercise price of $5.31 per share (the “Warrants”), including (i) a Series A Common Stock

Purchase Warrant exercisable for 7,000,000 shares of common stock commencing on September 30, 2023 and expiring on September 30,

2026, (ii) a Series B Common Stock Purchase Warrant exercisable for 7,000,000 shares of common stock commencing on September 30,

2026 and expiring on September 30, 2029, and (iii) a Series C Common Stock Purchase Warrant exercisable for 7,000,000 shares of

common stock commencing on September 30, 2029 and expiring on September 30, 2032. The Company has the right to accelerate or extend

the exercise period of each series of Warrants in its discretion. In addition, the exercise period of each series of Warrants

automatically accelerates in the event of a “change of control” (as defined in the Warrants) prior to such series

of Warrants becoming exercisable by its respective terms. The IP Asset Purchase Agreement contained customary indemnification

provisions.

The

foregoing description of the terms and conditions of the IP Asset Purchase Agreement and the Warrants is qualified in its entirety

by reference to the agreements which are filed as Exhibits 10.1, 4.1, 4.2 and 4.3, respectively, to this report.

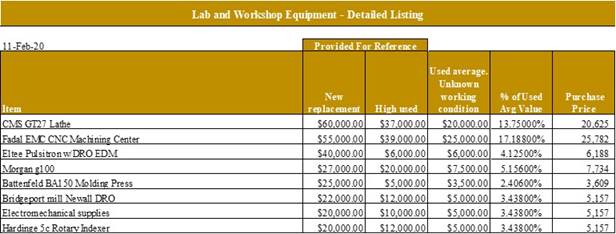

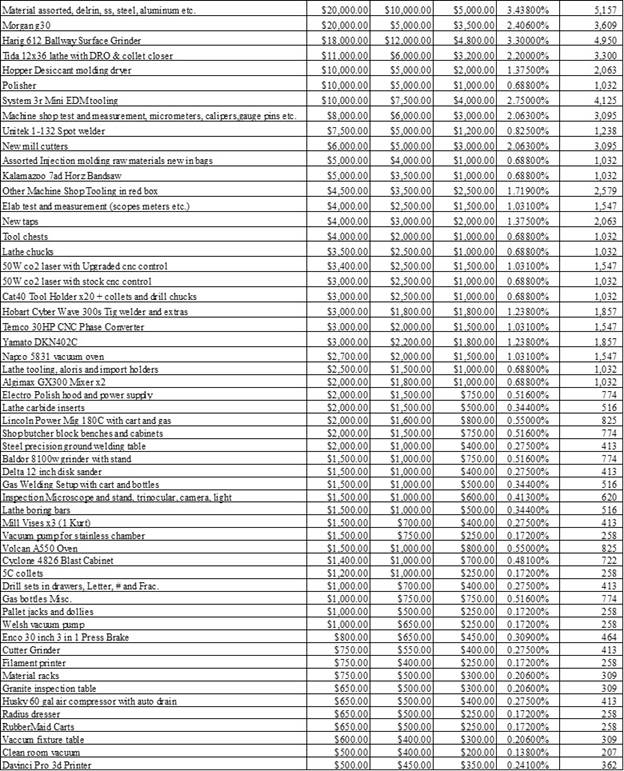

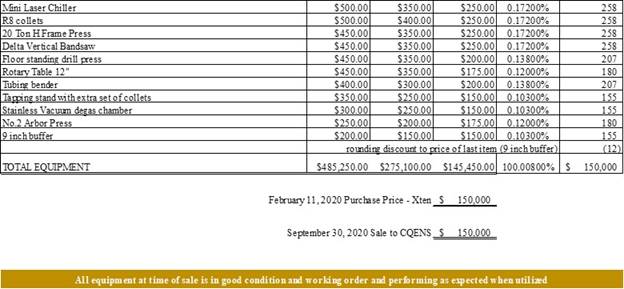

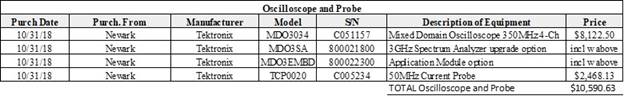

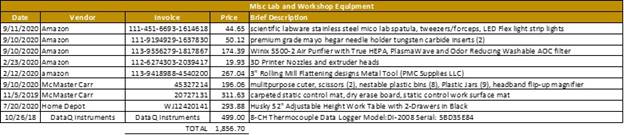

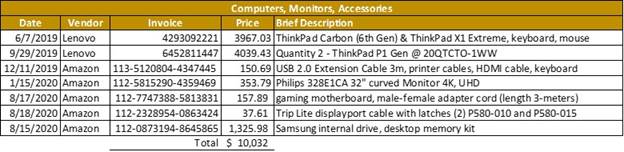

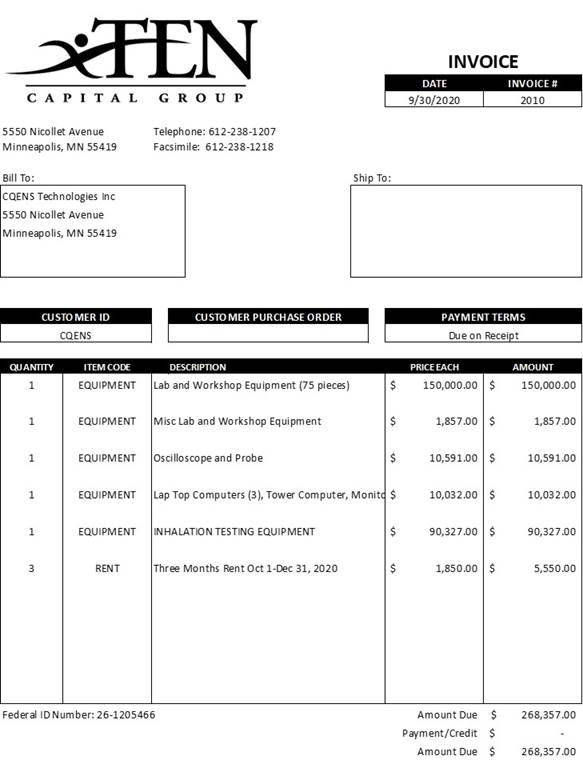

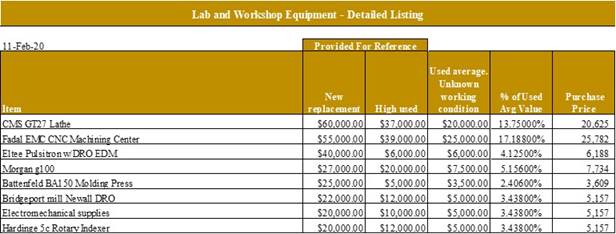

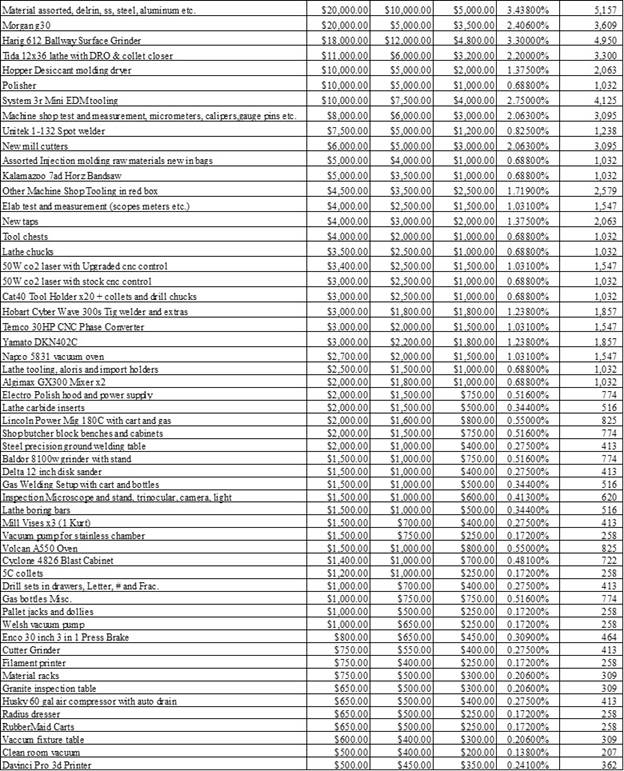

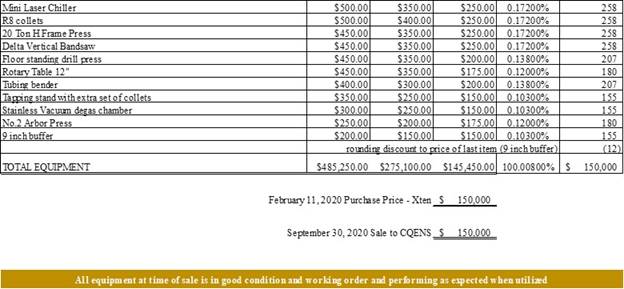

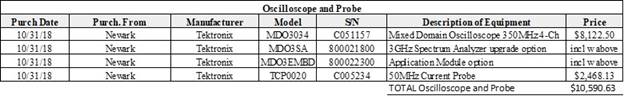

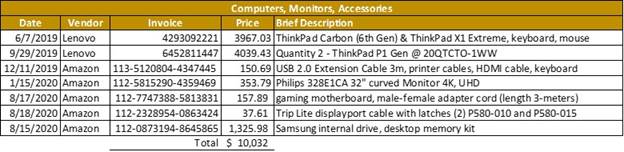

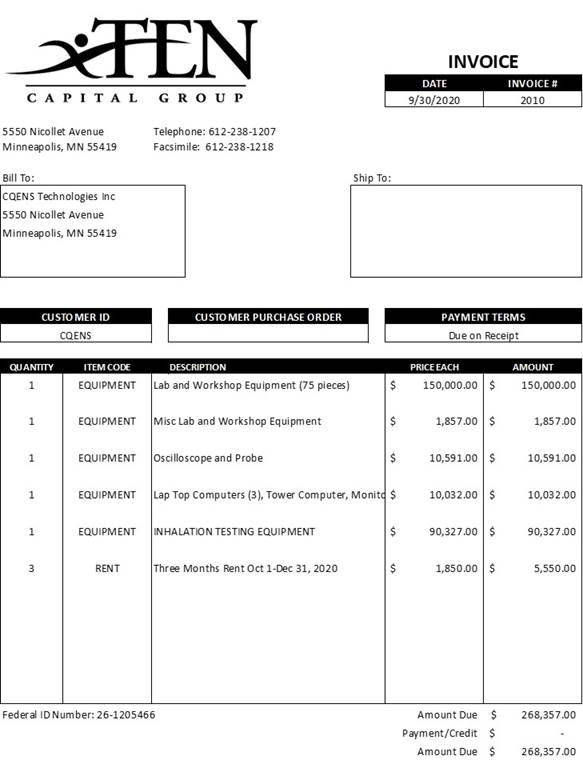

On

September 30, 2020 the Company also entered into a second Asset Purchase Agreement (the “Other Assets Asset Purchase Agreement”)

with Xten pursuant to which is acquired certain assets including, but not limited to, a custom built plume and inhalation testing

machine, oscilloscope with probe, multiple pieces of laboratory and workshop equipment, computers, monitors and accessories for

$268,357. The Other Assets Asset Purchase Agreement also contained customary indemnification provisions. The description of the

terms and conditions of the Other Assets Asset Purchase Agreement is qualified in its entirety by reference to the agreement which

is filed as Exhibit 10.2 to this report.

| Item

3.02 | Unregistered

Sales of Equity Securities. |

The

information which appears in Item 2.01 of this report is incorporated by reference herein.

| Item

9.01 | Financial

Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

CQENS

TECHNOLOGIES INC. |

| |

|

| Date:

October 2, 2020 |

By: |

/s/

William P. Bartkowski |

| |

|

William

P. Bartkowski, President |

Exhibit

4.1

FORM

OF SERIES A WARRANT

THE

SECURITIES EVIDENCED BY THIS WARRANT HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR ANY STATE SECURITIES

LAWS AND MAY NOT BE SOLD, TRANSFERRED, ASSIGNED, PLEDGED OR OTHERWISE DISPOSED OF WITHOUT (i) EFFECTIVE REGISTRATION STATEMENT

RELATED THERETO, (ii) AN OPINION OF COUNSEL OR OTHER EVIDENCE, REASONABLY SATISFACTORY TO THE COMPANY, THAT SUCH REGISTRATION

IS NOT REQUIRED, OR (iii) RECEIPT OF NO-ACTION LETTERS FROM THE APPROPRIATE GOVERNMENTAL AUTHORITIES.

September

30, 2020

CQENS

TECHNOLOGIES INC.

SERIES

A COMMON STOCK PURCHASE WARRANT

This

certifies that, for good and valuable consideration, receipt of which is hereby acknowledged, Xten Capital Group, Inc., a Minnesota

corporation (“Holder”) is entitled to purchase, subject to the terms and conditions of this Warrant,

from CQENS Technologies Inc., a Delaware corporation (the “Company”), Seven Million (7,000,000) fully

paid and nonassessable shares of the Company’s Common Stock, par value $0.0001 per share (“Common Stock”).

Holder shall be entitled to purchase the shares of Common Stock in accordance with Section 2 at any time subsequent to

the date of this Warrant set forth above and prior to the Expiration Date (as defined below). The shares of Common Stock of the

Company for which this Warrant is exercisable, as adjusted from time to time pursuant to the terms hereof, are hereinafter referred

to as the “Shares.” This Warrant is one of a series of Warrants issued and sold pursuant to the terms

and conditions of that certain Asset Purchase Agreement dated September 30, 2020 by and between the Holder and the Company (the

“Agreement”).

1. Exercise

Period; Price.

1.1 Exercise

Period. This Warrant shall be exercisable commencing September 30, 2023 and the exercise period (“Exercise

Period”) shall terminate at 5:00 p.m. Central time on September 30, 2026 (the “Expiration Date”).

In the Company’s sole discretion, it may accelerate the commencement of the Exercise Period or extend the Expiration Date

of this Warrant upon notice to the Holder.

1.2 Exercise

Price. The initial purchase price for each of the Shares shall be $5.31 per share. Such price shall be subject to adjustment

pursuant to the terms hereof (such price, as adjusted from time to time, is hereinafter referred to as the “Exercise

Price”).

2. Exercise

and Payment. At any time during the Exercise Period, this Warrant may be exercised, in whole or in part, from time to

time by the Holder, by surrender of this Warrant and the Notice of Exercise attached hereto as Annex I, duly completed

and executed by the Holder, to the Company at the principal executive offices of the Company, together with payment in the amount

obtained by multiplying the Exercise Price then in effect by the number of Shares thereby purchased, as designated in the Notice

of Exercise. Payment may be in cash, wire transfer or by check payable to the order of the Company in immediately available funds.

If not exercised in full, this Warrant must be exercised for a whole number of Shares.

3. Change

of Control. If at any time beginning upon the date of this Warrant and ending on September 29, 2023 a Change of Control

occurs, then this Warrant shall become immediately exercisable in accordance with its terms. For purposes hereof, a “Change

of Control” shall mean a change of control of a nature that would be required to be reported in response to Item

6(e) of Schedule 14A of Regulation 14A promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), whether or not the Company is in fact required to comply with that regulation, provided that, without limitation,

such a change in control shall be deemed to have occurred if (A) any “person” (as such term is used in Sections 13(d)

and 14(d) of the Exchange Act), other than a trustee or other fiduciary holding securities under an employee benefit plan of the

Company or a corporation owned, directly or indirectly, by the stockholders of the Company in substantially the same proportions

as their ownership of stock of the Company, is or becomes the “beneficial owner” (as defined in Rule 13d-3 under the

Exchange Act), directly or indirectly, acquires securities of the Company representing more than 50% of the combined voting power

of the Company’s then outstanding securities; or (B) during any period of two consecutive years (not including any period

prior to the execution of this Agreement), individuals who at the beginning of such period constitute the Board of Directors and

any new director whose election by the Board of Directors or nomination for election by the Company’s stockholders was approved

by a vote of at least two-thirds of the directors then still in office who either were directors at the beginning of the period

or whose election or nomination for election was previously so approved, cease for any reason to constitute a majority; (C) the

Company enters into a definitive agreement, the consummation of which would result in the occurrence of a change in control of

the Company; or (D) the stockholders of the Company approve a merger or consolidation of the Company with any other corporation,

other than a merger or consolidation which would result in the voting securities of the Company outstanding immediately prior

to it continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity)

of more than 50% of the combined voting power of the voting securities of the Company or such surviving entity outstanding immediately

after such merger or consolidation, or the stockholders of the Company approve a plan of complete liquidation of the Company or

an agreement for the sale or disposition by the Company of all or substantially all the Company’s assets.

4. Reservation

of Shares. The Company hereby agrees that at all times there shall be reserved for issuance and delivery upon exercise

of this Warrant such number of Shares or other shares of capital stock of the Company from time to time issuable upon exercise

of this Warrant . All such shares shall be duly authorized, and when issued upon such exercise, shall be validly issued, fully

paid and non-assessable, free and clear of all liens, security interests, charges and other encumbrances or restrictions on sale

and free and clear of all preemptive rights.

5. Delivery

of Stock Certificates. Within three (3) trading days after exercise, in whole or in part, of this Warrant, the Company

shall instruct its Transfer Agent to issue book entry shares in an account in the name of the holder or deliver to the Holder

a certificate or certificates for the number of fully paid and nonassessable Shares which the Holder shall have requested in the

Notice of Exercise. If this Warrant is exercised in part, the Company shall deliver to the Holder a new Warrant (dated the date

hereof and of like tenor) for the unexercised portion of this Warrant at the time of delivery of such stock certificate or certificates.

6. No

Fractional Shares. This Warrant must be exercised for a whole number of Shares. No fractional shares or scrip representing

fractional Shares will be issued upon exercise of this Warrant. Any fractional Share which otherwise might be issuable on the

exercise of this Warrant as a result of the adjustment provisions Section 10 hereof will be rounded up to the nearest whole Share.

7. Charges,

Taxes and Expenses. The Company shall pay all transfer taxes or other incidental charges, if any, in connection with the

transfer of the Shares purchased pursuant to the exercise hereof from the Company to the Holder.

8. Loss,

Theft, Destruction or Mutilation of Warrant. Upon receipt by the Company of evidence reasonably satisfactory to it of

the loss, theft, destruction or mutilation of this Warrant, and in case of loss, theft or destruction, of indemnity or security

reasonably satisfactory to the Company, and upon reimbursement to the Company of all reasonable expenses incidental thereto, and

upon surrender and cancellation of this Warrant, if mutilated, the Company will make and deliver a new Warrant of like tenor and

dated as of such cancellation, in lieu of this Warrant.

9. Saturdays,

Sundays, Holidays, Etc. If the last or appointed day for the taking of any action or the expiration of any right required

or granted herein shall be a Saturday or a Sunday or shall be a legal holiday, then such action may be taken or such right may

be exercised on the next succeeding weekday which is not a legal holiday.

10. Adjustment

of Exercise Price and Number of Shares. The Exercise Price and the number of and kind of securities purchasable upon exercise

of this Warrant shall be subject to adjustment from time to time as follows:

10.1 Subdivisions,

Combinations and Other Issuances. If the Company shall at any time after the date hereof but prior to the expiration of

this Warrant subdivide its outstanding securities as to which purchase rights under this Warrant exist, by split-up or otherwise,

or combine its outstanding securities as to which purchase rights under this Warrant exist, the number of Shares as to which this

Warrant is exercisable as of the date of such subdivision, split-up or combination shall forthwith be proportionately increased

in the case of a subdivision, or proportionately decreased in the case of a combination. Appropriate adjustments shall also be

made to the Exercise Price, but the aggregate purchase price payable for the total number of Shares purchasable under this Warrant

as of such date shall remain the same.

10.2 Stock

Dividend. If at any time after the date hereof the Company declares a dividend or other distribution on its Common Stock

payable in Common Stock or other securities or rights convertible into Common Stock (“Common Stock Equivalents”)

without payment of any consideration by such holder for the additional shares of Common Stock or Common Stock Equivalents (including

the additional shares of Common Stock issuable upon exercise or conversion thereof), then the number of Shares for which this

Warrant may be exercised shall be increased as of the record date (or the date of such dividend distribution if no record date

is set) for determining which holders of Common Stock shall be entitled to receive such dividend, in proportion to the increase

in the number of outstanding shares (and shares of Common Stock issuable upon conversion of all such securities convertible into

Common Stock) of Common Stock as a result of such dividend, and the Exercise Price shall be adjusted so that the aggregate amount

payable for the purchase of all the Shares issuable hereunder immediately after the record date (or on the date of such distribution,

if applicable), for such dividend shall equal the aggregate amount so payable immediately before such record date (or on the date

of such distribution, if applicable).

10.3 Other

Distributions. If at any time after the date hereof the Company distributes to holders of its Common Stock, other than

as part of its dissolution or liquidation or the winding up of its affairs, any shares of its capital stock, any evidence of indebtedness

or any of its assets (other than cash, Common Stock or Common Stock Equivalents), then the Company may, at its option, either

(i) decrease the Exercise Price of this Warrant by an appropriate amount based upon the value distributed on each share of Common

Stock as determined in good faith by the Company’s Board of Directors, or (ii) provide by resolution of the Company’s

Board of Directors that on exercise of this Warrant, the Holder hereof shall thereafter be entitled to receive, in addition to

the shares of Common Stock otherwise receivable on exercise hereof, the number of shares or other securities or property which

would have been received had this Warrant at the time been exercised.

10.4 Effect

of Consolidation, Merger or Sale. In case of any reclassification, capital reorganization, or change of securities of

the class issuable upon exercise of this Warrant (other than a change in par value, or from par value to no par value, or from

no par value to par value, or as a result of any subdivision, combination, stock dividend or other distribution provided for in

Sections 10.1, 10.2 and 10.3 above), or in case of any consolidation or merger of the Company with or into

any corporation (other than a consolidation or merger with another corporation in which the Company is the acquiring and the surviving

corporation and which does not result in any reclassification or change of outstanding securities issuable upon exercise of this

Warrant), or in case of any sale of all or substantially all of the assets of the Company, the Company, or such successor or purchasing

corporation, as the case may be, shall duly execute and deliver to the holder of this Warrant a new Warrant (in form and substance

satisfactory to the holder of this Warrant), or the Company shall make appropriate provision without the issuance of a new Warrant,

so that the holder of this Warrant shall have the right to receive, at a total purchase price not to exceed that payable upon

the exercise of the unexercised portion of this Warrant, and in lieu of the Shares theretofore issuable upon exercise of this

Warrant, the kind and amount of shares of stock, other securities, money and property receivable upon such reclassification, capital

reorganization, change, merger or sale by a holder of the number of Shares then purchasable under this Warrant. In any such case,

appropriate provisions shall be made with respect to the rights and interest of Holder so that the provisions hereof shall thereafter

be applicable to any shares of stock or other securities and property deliverable upon exercise hereof, or to any new Warrant

delivered pursuant to this Section 10.4, and appropriate adjustments shall be made to the Exercise Price per share payable

hereunder, provided, that the aggregate Exercise Price shall remain the same. The provisions of this Section 10.4 shall

similarly apply to successive reclassifications, capital reorganizations, changes, mergers and transfers.

11. Notice

of Adjustments; Notices. Whenever the Exercise Price or number of Shares purchasable hereunder shall be adjusted pursuant

to Section 10 hereof, the Company shall execute and deliver to the Holder a certificate setting forth, in reasonable detail,

the event requiring the adjustment, the amount of the adjustment, the method by which such adjustment was calculated and the Exercise

Price and number of and kind of securities purchasable hereunder after giving effect to such adjustment, and shall cause a copy

of such certificate to be mailed (by first class mail, postage prepaid) to the Holder.

12. Rights

As Stockholder; Notice to Holders. Nothing contained in this Warrant shall be construed as conferring upon the Holder

or his or its transferees the right to vote or to receive dividends or to consent or to receive notice as a stockholder in respect

of any meeting of stockholders for the election of directors of the Company or of any other matter, or any rights whatsoever as

stockholders of the Company. The Company shall give notice to the Holder by registered mail if at any time prior to the expiration

or exercise in full of the Warrants, any of the following events shall occur:

(i) a

dissolution, liquidation or winding up of the Company shall be proposed;

(ii) a

capital reorganization or reclassification of the Common Stock (other than a change in par value, or from par value to no par

value, or from no par value to par value, or as a result of any subdivision, combination, stock dividend or other distribution)

or any consolidation or merger of the Company with or into another corporation (other than a consolidation or merger with another

corporation in which the Company is the acquiring and the surviving corporation and which does not result in any reclassification

or change of outstanding securities issuable upon exercise of this Warrant), or in case of any sale of all or substantially all

of the assets of the Company; or

(iii) a

taking by the Company of a record of the holders of any class of securities for the purpose of determining the holders thereof

who are entitled to receive any dividend (other than a cash dividend) for other distribution, any right to subscribe for, purchase

or otherwise acquire any shares of stock of any class or any other securities or property, or to receive any other rights.

Such

giving of notice shall be simultaneous with (or in any event, no later than) the giving of notice to holders of Common Stock.

Such notice shall specify the record date or the date of closing the stock transfer books, as the case may be. Failure to provide

such notice shall not affect the validity of any action contemplated in this Section 12.

13. Restricted

Securities. The Holder understands that this Warrant and the Shares purchasable hereunder constitute “restricted

securities” under the federal securities laws inasmuch as they are, or will be, acquired from the Company in transactions

not involving a public offering and accordingly may not, under such laws and applicable regulations, be resold or transferred

without registration under the Act, or an applicable exemption from such registration. The Holder further acknowledges that a

securities legend to the foregoing effect shall be placed on any Shares issued to the Holder upon exercise of this Warrant.

14. Disposition

of Shares; Transferability.

14.1 Transfer.

This Warrant shall be transferable only on the books of the Company, upon delivery thereof duly endorsed by the Holder or by its

duly authorized attorney or representative, accompanied by proper evidence of succession, assignment or authority to transfer.

Upon any registration of transfer, the Company shall execute and deliver new Warrants to the person entitled thereto.

14.2 Rights,

Preferences and Privileges of Common Stock. The powers, preferences, rights, restrictions and other matters relating to

the shares of Common Stock will be as determined in the Company’s Amended and Restated Certificate of Incorporation, as

amended, as then in effect.

15. Miscellaneous.

15.1 Binding

Effect. This Warrant and the various rights and obligations arising hereunder shall be binding upon and inure to the benefit

of the parties hereto and their respective successors and assigns.

15.2 Entire

Agreement. This Warrant, the Purchase Agreement and the Registration Rights Agreement of even date herewith constitute

the entire agreement between the parties with respect to the subject matter hereof and supersede all prior and contemporaneous

agreements, whether oral or written, between the parties hereto with respect to the subject matter hereof.

15.3 Amendment

and Waiver. Any term of this Warrant may be amended and the observance of any term hereof may be waived (either generally

or in a particular instance and either retroactively or prospectively), with the written consent of the Company and the Holders

representing a majority-in-interest of the Shares underlying the Warrants pursuant to the Purchase Agreement. Any waiver or amendment

effected in accordance with this Section 15.3 shall be binding upon the Holder and the Company.

15.4 Governing

Law. This Agreement shall be governed by and construed under the laws of the State of Delaware without reference to the

conflicts of law principles thereof. The exclusive jurisdiction for any legal suit, action or proceeding arising out of or related

to this Warrant shall be either the United States District Court for the District of Minnesota.

15.5 Headings.

The headings in this Agreement are for convenience only and shall not alter or otherwise affect the meaning hereof.

15.6 Severability.

If one or more provisions of this Warrant are held to be unenforceable under applicable law, such provision shall be excluded

from this Warrant and the balance of the Warrant shall be interpreted as if such provision were so excluded and the balance shall

be enforceable in accordance with its terms.

15.7 Notices.

Unless otherwise provided, any notice required or permitted under this Warrant shall be given in the same manner as provided in

the Agreement.

IN

WITNESS WHEREOF, the parties hereto have executed and delivered this Warrant as of the date appearing on the first page of

this Warrant.

| |

THE

COMPANY: |

| |

|

| |

CQENS

TECHNOLOGIES INC. |

| |

|

| |

By:

|

|

| |

William

P. Bartkowski, President and Chief Operating Officer |

ANNEX

I

NOTICE

OF EXERCISE OF SERIES A COMMON STOCK PURCHASE WARRANT

To: CQENS

Technologies Inc.

1. The

undersigned Holder hereby elects to purchase _____________ shares of common stock, $0.0001 par value per share (the “Shares”)

of CQENS Technologies Inc., a Delaware corporation (the “Company”), pursuant to the terms of the attached

Warrant. The Holder shall make payment of the Exercise Price by delivering the sum of $____________, in lawful money of the United

States, to the Company in accordance with the terms of the Warrant.

2. Please

deposit book entry shares totaling _________shares in the following account on the records of the Company’s Transfer Agent

or lease issue and deliver certificates representing the Warrant Shares purchased hereunder to Holder:

Address: in

the following denominations: ____________________________.

Taxpayer

ID No.: __________________________________

3. Please

issue a new Warrant for the unexercised portion of the attached Warrant, if any, in the name of the undersigned.

| Holder: |

|

|

| Dated: |

|

|

| By: |

|

|

| Its: |

|

|

| Address: |

|

|

4. The

undersigned is an “accredited investor” as defined in Regulation D promulgated under the Securities Act of 1933, as

amended.

SIGNATURE

OF HOLDER

| Name

of Investing Entity: |

|

| Signature

of Authorized Signatory of Investing Entity: |

|

| Name

of Authorized Signatory: |

|

| Title

of Authorized Signatory: |

|

Exhibit

4.2

FORM

OF SERIES B WARRANT

THE

SECURITIES EVIDENCED BY THIS WARRANT HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR ANY STATE SECURITIES

LAWS AND MAY NOT BE SOLD, TRANSFERRED, ASSIGNED, PLEDGED OR OTHERWISE DISPOSED OF WITHOUT (i) EFFECTIVE REGISTRATION STATEMENT

RELATED THERETO, (ii) AN OPINION OF COUNSEL OR OTHER EVIDENCE, REASONABLY SATISFACTORY TO THE COMPANY, THAT SUCH REGISTRATION

IS NOT REQUIRED, OR (iii) RECEIPT OF NO-ACTION LETTERS FROM THE APPROPRIATE GOVERNMENTAL AUTHORITIES.

September

30, 2020

CQENS

TECHNOLOGIES INC.

SERIES

B COMMON STOCK PURCHASE WARRANT

This

certifies that, for good and valuable consideration, receipt of which is hereby acknowledged, Xten Capital Group, Inc., a Minnesota

corporation (“Holder”) is entitled to purchase, subject to the terms and conditions of this Warrant,

from CQENS Technologies Inc., a Delaware corporation (the “Company”), Seven Million (7,000,000) fully

paid and nonassessable shares of the Company’s Common Stock, par value $0.0001 per share (“Common Stock”).

Holder shall be entitled to purchase the shares of Common Stock in accordance with Section 2 at any time subsequent to

the date of this Warrant set forth above and prior to the Expiration Date (as defined below). The shares of Common Stock of the

Company for which this Warrant is exercisable, as adjusted from time to time pursuant to the terms hereof, are hereinafter referred

to as the “Shares.” This Warrant is one of a series of Warrants issued and sold pursuant to the terms

and conditions of that certain Asset Purchase Agreement dated September 30, 2020 by and between the Holder and the Company (the

“Agreement”).

1. Exercise

Period; Price.

1.1 Exercise

Period. This Warrant shall be exercisable commencing September 30, 2026 and the exercise period (“Exercise

Period”) shall terminate at 5:00 p.m. Central time on September 30, 2029 (the “Expiration Date”).

In the Company’s sole discretion, it may accelerate the commencement of the Exercise Period or extend the Expiration Date

of this Warrant upon notice to the Holder.

1.2 Exercise

Price. The initial purchase price for each of the Shares shall be $5.31 per share. Such price shall be subject to adjustment

pursuant to the terms hereof (such price, as adjusted from time to time, is hereinafter referred to as the “Exercise

Price”).

2. Exercise

and Payment. At any time during the Exercise Period, this Warrant may be exercised, in whole or in part, from time to

time by the Holder, by surrender of this Warrant and the Notice of Exercise attached hereto as Annex I, duly completed

and executed by the Holder, to the Company at the principal executive offices of the Company, together with payment in the amount

obtained by multiplying the Exercise Price then in effect by the number of Shares thereby purchased, as designated in the Notice

of Exercise. Payment may be in cash, wire transfer or by check payable to the order of the Company in immediately available funds.

If not exercised in full, this Warrant must be exercised for a whole number of Shares.

3. Change

of Control. If at any time beginning upon the date of this Warrant and ending on September 29, 2026 a Change of Control

occurs, then this Warrant shall become immediately exercisable in accordance with its terms. For purposes hereof, a “Change

of Control” shall mean a change of control of a nature that would be required to be reported in response to Item

6(e) of Schedule 14A of Regulation 14A promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), whether or not the Company is in fact required to comply with that regulation, provided that, without limitation,

such a change in control shall be deemed to have occurred if (A) any “person” (as such term is used in Sections 13(d)

and 14(d) of the Exchange Act), other than a trustee or other fiduciary holding securities under an employee benefit plan of the

Company or a corporation owned, directly or indirectly, by the stockholders of the Company in substantially the same proportions

as their ownership of stock of the Company, is or becomes the “beneficial owner” (as defined in Rule 13d-3 under the

Exchange Act), directly or indirectly, acquires securities of the Company representing more than 50% of the combined voting power

of the Company’s then outstanding securities; or (B) during any period of two consecutive years (not including any period

prior to the execution of this Agreement), individuals who at the beginning of such period constitute the Board of Directors and

any new director whose election by the Board of Directors or nomination for election by the Company’s stockholders was approved

by a vote of at least two-thirds of the directors then still in office who either were directors at the beginning of the period

or whose election or nomination for election was previously so approved, cease for any reason to constitute a majority; (C) the

Company enters into a definitive agreement, the consummation of which would result in the occurrence of a change in control of

the Company; or (D) the stockholders of the Company approve a merger or consolidation of the Company with any other corporation,

other than a merger or consolidation which would result in the voting securities of the Company outstanding immediately prior

to it continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity)

of more than 50% of the combined voting power of the voting securities of the Company or such surviving entity outstanding immediately

after such merger or consolidation, or the stockholders of the Company approve a plan of complete liquidation of the Company or

an agreement for the sale or disposition by the Company of all or substantially all the Company’s assets.

4. Reservation

of Shares. The Company hereby agrees that at all times there shall be reserved for issuance and delivery upon exercise

of this Warrant such number of Shares or other shares of capital stock of the Company from time to time issuable upon exercise

of this Warrant . All such shares shall be duly authorized, and when issued upon such exercise, shall be validly issued, fully

paid and non-assessable, free and clear of all liens, security interests, charges and other encumbrances or restrictions on sale

and free and clear of all preemptive rights.

5. Delivery

of Stock Certificates. Within three (3) trading days after exercise, in whole or in part, of this Warrant, the Company

shall instruct its Transfer Agent to issue book entry shares in an account in the name of the holder or deliver to the Holder

a certificate or certificates for the number of fully paid and nonassessable Shares which the Holder shall have requested in the

Notice of Exercise. If this Warrant is exercised in part, the Company shall deliver to the Holder a new Warrant (dated the date

hereof and of like tenor) for the unexercised portion of this Warrant at the time of delivery of such stock certificate or certificates.

6. No

Fractional Shares. This Warrant must be exercised for a whole number of Shares. No fractional shares or scrip representing

fractional Shares will be issued upon exercise of this Warrant. Any fractional Share which otherwise might be issuable on the

exercise of this Warrant as a result of the adjustment provisions Section 10 hereof will be rounded up to the nearest whole Share.

7. Charges,

Taxes and Expenses. The Company shall pay all transfer taxes or other incidental charges, if any, in connection with the

transfer of the Shares purchased pursuant to the exercise hereof from the Company to the Holder.

8. Loss,

Theft, Destruction or Mutilation of Warrant. Upon receipt by the Company of evidence reasonably satisfactory to it of

the loss, theft, destruction or mutilation of this Warrant, and in case of loss, theft or destruction, of indemnity or security

reasonably satisfactory to the Company, and upon reimbursement to the Company of all reasonable expenses incidental thereto, and

upon surrender and cancellation of this Warrant, if mutilated, the Company will make and deliver a new Warrant of like tenor and

dated as of such cancellation, in lieu of this Warrant.

9. Saturdays,

Sundays, Holidays, Etc. If the last or appointed day for the taking of any action or the expiration of any right required

or granted herein shall be a Saturday or a Sunday or shall be a legal holiday, then such action may be taken or such right may

be exercised on the next succeeding weekday which is not a legal holiday.

10. Adjustment

of Exercise Price and Number of Shares. The Exercise Price and the number of and kind of securities purchasable upon exercise

of this Warrant shall be subject to adjustment from time to time as follows:

10.1 Subdivisions,

Combinations and Other Issuances. If the Company shall at any time after the date hereof but prior to the expiration of

this Warrant subdivide its outstanding securities as to which purchase rights under this Warrant exist, by split-up or otherwise,

or combine its outstanding securities as to which purchase rights under this Warrant exist, the number of Shares as to which this

Warrant is exercisable as of the date of such subdivision, split-up or combination shall forthwith be proportionately increased

in the case of a subdivision, or proportionately decreased in the case of a combination. Appropriate adjustments shall also be

made to the Exercise Price, but the aggregate purchase price payable for the total number of Shares purchasable under this Warrant

as of such date shall remain the same.

10.2 Stock

Dividend. If at any time after the date hereof the Company declares a dividend or other distribution on its Common Stock

payable in Common Stock or other securities or rights convertible into Common Stock (“Common Stock Equivalents”)

without payment of any consideration by such holder for the additional shares of Common Stock or Common Stock Equivalents (including

the additional shares of Common Stock issuable upon exercise or conversion thereof), then the number of Shares for which this

Warrant may be exercised shall be increased as of the record date (or the date of such dividend distribution if no record date

is set) for determining which holders of Common Stock shall be entitled to receive such dividend, in proportion to the increase

in the number of outstanding shares (and shares of Common Stock issuable upon conversion of all such securities convertible into

Common Stock) of Common Stock as a result of such dividend, and the Exercise Price shall be adjusted so that the aggregate amount

payable for the purchase of all the Shares issuable hereunder immediately after the record date (or on the date of such distribution,

if applicable), for such dividend shall equal the aggregate amount so payable immediately before such record date (or on the date

of such distribution, if applicable).

10.3 Other

Distributions. If at any time after the date hereof the Company distributes to holders of its Common Stock, other than

as part of its dissolution or liquidation or the winding up of its affairs, any shares of its capital stock, any evidence of indebtedness

or any of its assets (other than cash, Common Stock or Common Stock Equivalents), then the Company may, at its option, either

(i) decrease the Exercise Price of this Warrant by an appropriate amount based upon the value distributed on each share of Common

Stock as determined in good faith by the Company’s Board of Directors, or (ii) provide by resolution of the Company’s

Board of Directors that on exercise of this Warrant, the Holder hereof shall thereafter be entitled to receive, in addition to

the shares of Common Stock otherwise receivable on exercise hereof, the number of shares or other securities or property which

would have been received had this Warrant at the time been exercised.

10.4 Effect

of Consolidation, Merger or Sale. In case of any reclassification, capital reorganization, or change of securities of

the class issuable upon exercise of this Warrant (other than a change in par value, or from par value to no par value, or from

no par value to par value, or as a result of any subdivision, combination, stock dividend or other distribution provided for in

Sections 10.1, 10.2 and 10.3 above), or in case of any consolidation or merger of the Company with or into

any corporation (other than a consolidation or merger with another corporation in which the Company is the acquiring and the surviving

corporation and which does not result in any reclassification or change of outstanding securities issuable upon exercise of this

Warrant), or in case of any sale of all or substantially all of the assets of the Company, the Company, or such successor or purchasing

corporation, as the case may be, shall duly execute and deliver to the holder of this Warrant a new Warrant (in form and substance

satisfactory to the holder of this Warrant), or the Company shall make appropriate provision without the issuance of a new Warrant,

so that the holder of this Warrant shall have the right to receive, at a total purchase price not to exceed that payable upon

the exercise of the unexercised portion of this Warrant, and in lieu of the Shares theretofore issuable upon exercise of this

Warrant, the kind and amount of shares of stock, other securities, money and property receivable upon such reclassification, capital

reorganization, change, merger or sale by a holder of the number of Shares then purchasable under this Warrant. In any such case,

appropriate provisions shall be made with respect to the rights and interest of Holder so that the provisions hereof shall thereafter

be applicable to any shares of stock or other securities and property deliverable upon exercise hereof, or to any new Warrant

delivered pursuant to this Section 10.4, and appropriate adjustments shall be made to the Exercise Price per share payable

hereunder, provided, that the aggregate Exercise Price shall remain the same. The provisions of this Section 10.4 shall

similarly apply to successive reclassifications, capital reorganizations, changes, mergers and transfers.

11. Notice

of Adjustments; Notices. Whenever the Exercise Price or number of Shares purchasable hereunder shall be adjusted pursuant

to Section 10 hereof, the Company shall execute and deliver to the Holder a certificate setting forth, in reasonable detail,

the event requiring the adjustment, the amount of the adjustment, the method by which such adjustment was calculated and the Exercise

Price and number of and kind of securities purchasable hereunder after giving effect to such adjustment, and shall cause a copy

of such certificate to be mailed (by first class mail, postage prepaid) to the Holder.

12. Rights

As Stockholder; Notice to Holders. Nothing contained in this Warrant shall be construed as conferring upon the Holder

or his or its transferees the right to vote or to receive dividends or to consent or to receive notice as a stockholder in respect

of any meeting of stockholders for the election of directors of the Company or of any other matter, or any rights whatsoever as

stockholders of the Company. The Company shall give notice to the Holder by registered mail if at any time prior to the expiration

or exercise in full of the Warrants, any of the following events shall occur:

(i) a

dissolution, liquidation or winding up of the Company shall be proposed;

(ii) a

capital reorganization or reclassification of the Common Stock (other than a change in par value, or from par value to no par

value, or from no par value to par value, or as a result of any subdivision, combination, stock dividend or other distribution)

or any consolidation or merger of the Company with or into another corporation (other than a consolidation or merger with another

corporation in which the Company is the acquiring and the surviving corporation and which does not result in any reclassification

or change of outstanding securities issuable upon exercise of this Warrant), or in case of any sale of all or substantially all

of the assets of the Company; or

(iii) a

taking by the Company of a record of the holders of any class of securities for the purpose of determining the holders thereof

who are entitled to receive any dividend (other than a cash dividend) for other distribution, any right to subscribe for, purchase

or otherwise acquire any shares of stock of any class or any other securities or property, or to receive any other rights.

Such

giving of notice shall be simultaneous with (or in any event, no later than) the giving of notice to holders of Common Stock.

Such notice shall specify the record date or the date of closing the stock transfer books, as the case may be. Failure to provide

such notice shall not affect the validity of any action contemplated in this Section 12.

13. Restricted

Securities. The Holder understands that this Warrant and the Shares purchasable hereunder constitute “restricted

securities” under the federal securities laws inasmuch as they are, or will be, acquired from the Company in transactions

not involving a public offering and accordingly may not, under such laws and applicable regulations, be resold or transferred

without registration under the Act, or an applicable exemption from such registration. The Holder further acknowledges that a

securities legend to the foregoing effect shall be placed on any Shares issued to the Holder upon exercise of this Warrant.

14. Disposition

of Shares; Transferability.

14.1 Transfer.

This Warrant shall be transferable only on the books of the Company, upon delivery thereof duly endorsed by the Holder or by its

duly authorized attorney or representative, accompanied by proper evidence of succession, assignment or authority to transfer.

Upon any registration of transfer, the Company shall execute and deliver new Warrants to the person entitled thereto.

14.2 Rights,

Preferences and Privileges of Common Stock. The powers, preferences, rights, restrictions and other matters relating to

the shares of Common Stock will be as determined in the Company’s Amended and Restated Certificate of Incorporation, as

amended, as then in effect.

15. Miscellaneous.

15.1 Binding

Effect. This Warrant and the various rights and obligations arising hereunder shall be binding upon and inure to the benefit

of the parties hereto and their respective successors and assigns.

15.2 Entire

Agreement. This Warrant, the Purchase Agreement and the Registration Rights Agreement of even date herewith constitute

the entire agreement between the parties with respect to the subject matter hereof and supersede all prior and contemporaneous

agreements, whether oral or written, between the parties hereto with respect to the subject matter hereof.

15.3 Amendment

and Waiver. Any term of this Warrant may be amended and the observance of any term hereof may be waived (either generally

or in a particular instance and either retroactively or prospectively), with the written consent of the Company and the Holders

representing a majority-in-interest of the Shares underlying the Warrants pursuant to the Purchase Agreement. Any waiver or amendment

effected in accordance with this Section 15.3 shall be binding upon the Holder and the Company.

15.4 Governing

Law. This Agreement shall be governed by and construed under the laws of the State of Delaware without reference to the

conflicts of law principles thereof. The exclusive jurisdiction for any legal suit, action or proceeding arising out of or related

to this Warrant shall be either the United States District Court for the District of Minnesota.

15.5 Headings.

The headings in this Agreement are for convenience only and shall not alter or otherwise affect the meaning hereof.

15.6 Severability.

If one or more provisions of this Warrant are held to be unenforceable under applicable law, such provision shall be excluded

from this Warrant and the balance of the Warrant shall be interpreted as if such provision were so excluded and the balance shall

be enforceable in accordance with its terms.

15.7 Notices.

Unless otherwise provided, any notice required or permitted under this Warrant shall be given in the same manner as provided in

the Agreement.

IN

WITNESS WHEREOF, the parties hereto have executed and delivered this Warrant as of the date appearing on the first page of

this Warrant.

| |

THE

COMPANY: |

| |

|

| |

CQENS

TECHNOLOGIES INC. |

| |

|

| |

By:

|

|

| |

William

P. Bartkowski, President and Chief Operating Officer |

ANNEX

I

NOTICE

OF EXERCISE OF SERIES B COMMON STOCK PURCHASE WARRANT

To: CQENS

Technologies Inc.

1. The

undersigned Holder hereby elects to purchase _____________ shares of common stock, $0.0001 par value per share (the “Shares”)

of CQENS Technologies Inc., a Delaware corporation (the “Company”), pursuant to the terms of the attached

Warrant. The Holder shall make payment of the Exercise Price by delivering the sum of $____________, in lawful money of the United

States, to the Company in accordance with the terms of the Warrant.

2. Please

deposit book entry shares totaling _________shares in the following account on the records of the Company’s Transfer Agent

or lease issue and deliver certificates representing the Warrant Shares purchased hereunder to Holder: Address:

in the following denominations: ____________________________.

Taxpayer

ID No.: __________________________________

3. Please

issue a new Warrant for the unexercised portion of the attached Warrant, if any, in the name of the undersigned.

| Holder: |

|

|

| Dated: |

|

|

| By: |

|

|

| Its: |

|

|

| Address: |

|

|

4. The

undersigned is an “accredited investor” as defined in Regulation D promulgated under the Securities Act of 1933, as

amended.

SIGNATURE

OF HOLDER

| Name

of Investing Entity: |

|

| Signature

of Authorized Signatory of Investing Entity: |

|

| Name

of Authorized Signatory: |

|

| Title

of Authorized Signatory: |

|

Exhibit 4.3

FORM OF SERIES C WARRANT

THE SECURITIES EVIDENCED BY THIS WARRANT

HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR ANY STATE SECURITIES LAWS AND MAY NOT BE SOLD, TRANSFERRED,

ASSIGNED, PLEDGED OR OTHERWISE DISPOSED OF WITHOUT (i) EFFECTIVE REGISTRATION STATEMENT RELATED THERETO, (ii) AN OPINION OF COUNSEL

OR OTHER EVIDENCE, REASONABLY SATISFACTORY TO THE COMPANY, THAT SUCH REGISTRATION IS NOT REQUIRED, OR (iii) RECEIPT OF NO-ACTION

LETTERS FROM THE APPROPRIATE GOVERNMENTAL AUTHORITIES.

September 30, 2020

CQENS TECHNOLOGIES INC.

SERIES C COMMON STOCK PURCHASE WARRANT

This certifies that, for

good and valuable consideration, receipt of which is hereby acknowledged, Xten Capital Group, Inc., a Minnesota corporation (“Holder”)

is entitled to purchase, subject to the terms and conditions of this Warrant, from CQENS Technologies Inc., a Delaware corporation

(the “Company”), Seven Million (7,000,000) fully paid and nonassessable shares of the Company’s

Common Stock, par value $0.0001 per share (“Common Stock”). Holder shall be entitled to purchase the

shares of Common Stock in accordance with Section 2 at any time subsequent to the date of this Warrant set forth above and

prior to the Expiration Date (as defined below). The shares of Common Stock of the Company for which this Warrant is exercisable,

as adjusted from time to time pursuant to the terms hereof, are hereinafter referred to as the “Shares.”

This Warrant is one of a series of Warrants issued and sold pursuant to the terms and conditions of that certain Asset Purchase

Agreement dated September 30, 2020 by and between the Holder and the Company (the “Agreement”).

1. Exercise

Period; Price.

1.1 Exercise

Period. This Warrant shall be exercisable commencing September 30, 2029 and the exercise period (“Exercise

Period”) shall terminate at 5:00 p.m. Central time on September 30, 2032 (the “Expiration Date”).

In the Company’s sole discretion, it may accelerate the commencement of the Exercise Period or extend the Expiration Date

of this Warrant upon notice to the Holder.

1.2 Exercise

Price. The initial purchase price for each of the Shares shall be $5.31 per share. Such price shall be subject to adjustment

pursuant to the terms hereof (such price, as adjusted from time to time, is hereinafter referred to as the “Exercise

Price”).

2. Exercise

and Payment. At any time during the Exercise Period, this Warrant may be exercised, in whole or in part, from time to time

by the Holder, by surrender of this Warrant and the Notice of Exercise attached hereto as Annex I, duly completed and executed

by the Holder, to the Company at the principal executive offices of the Company, together with payment in the amount obtained by

multiplying the Exercise Price then in effect by the number of Shares thereby purchased, as designated in the Notice of Exercise.

Payment may be in cash, wire transfer or by check payable to the order of the Company in immediately available funds. If not exercised

in full, this Warrant must be exercised for a whole number of Shares.

3. Change

of Control. If at any time beginning upon the date of this Warrant and ending on September 29, 2029 a Change of Control

occurs, then this Warrant shall become immediately exercisable in accordance with its terms. For purposes hereof, a “Change

of Control” shall mean a change of control of a nature that would be required to be reported in response to Item

6(e) of Schedule 14A of Regulation 14A promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), whether or not the Company is in fact required to comply with that regulation, provided that, without limitation,

such a change in control shall be deemed to have occurred if (A) any “person” (as such term is used in Sections 13(d)

and 14(d) of the Exchange Act), other than a trustee or other fiduciary holding securities under an employee benefit plan of the

Company or a corporation owned, directly or indirectly, by the stockholders of the Company in substantially the same proportions

as their ownership of stock of the Company, is or becomes the “beneficial owner” (as defined in Rule 13d-3 under the

Exchange Act), directly or indirectly, acquires securities of the Company representing more than 50% of the combined voting power

of the Company’s then outstanding securities; or (B) during any period of two consecutive years (not including any period

prior to the execution of this Agreement), individuals who at the beginning of such period constitute the Board of Directors and

any new director whose election by the Board of Directors or nomination for election by the Company’s stockholders was approved

by a vote of at least two-thirds of the directors then still in office who either were directors at the beginning of the period

or whose election or nomination for election was previously so approved, cease for any reason to constitute a majority; (C) the

Company enters into a definitive agreement, the consummation of which would result in the occurrence of a change in control of

the Company; or (D) the stockholders of the Company approve a merger or consolidation of the Company with any other corporation,

other than a merger or consolidation which would result in the voting securities of the Company outstanding immediately prior to

it continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity)

of more than 50% of the combined voting power of the voting securities of the Company or such surviving entity outstanding immediately

after such merger or consolidation, or the stockholders of the Company approve a plan of complete liquidation of the Company or

an agreement for the sale or disposition by the Company of all or substantially all the Company’s assets.

4. Reservation

of Shares. The Company hereby agrees that at all times there shall be reserved for issuance and delivery upon exercise

of this Warrant such number of Shares or other shares of capital stock of the Company from time to time issuable upon exercise

of this Warrant . All such shares shall be duly authorized, and when issued upon such exercise, shall be validly issued, fully

paid and non-assessable, free and clear of all liens, security interests, charges and other encumbrances or restrictions on sale

and free and clear of all preemptive rights.

5. Delivery

of Stock Certificates. Within three (3) trading days after exercise, in whole or in part, of this Warrant, the Company

shall instruct its Transfer Agent to issue book entry shares in an account in the name of the holder or deliver to the Holder a

certificate or certificates for the number of fully paid and nonassessable Shares which the Holder shall have requested in the

Notice of Exercise. If this Warrant is exercised in part, the Company shall deliver to the Holder a new Warrant (dated the date

hereof and of like tenor) for the unexercised portion of this Warrant at the time of delivery of such stock certificate or certificates.

6. No

Fractional Shares. This Warrant must be exercised for a whole number of Shares. No fractional shares or scrip representing

fractional Shares will be issued upon exercise of this Warrant. Any fractional Share which otherwise might be issuable on the exercise

of this Warrant as a result of the adjustment provisions Section 10 hereof will be rounded up to the nearest whole Share.

7. Charges,

Taxes and Expenses. The Company shall pay all transfer taxes or other incidental charges, if any, in connection with the

transfer of the Shares purchased pursuant to the exercise hereof from the Company to the Holder.

8. Loss,

Theft, Destruction or Mutilation of Warrant. Upon receipt by the Company of evidence reasonably satisfactory to it of the

loss, theft, destruction or mutilation of this Warrant, and in case of loss, theft or destruction, of indemnity or security reasonably

satisfactory to the Company, and upon reimbursement to the Company of all reasonable expenses incidental thereto, and upon surrender

and cancellation of this Warrant, if mutilated, the Company will make and deliver a new Warrant of like tenor and dated as of such

cancellation, in lieu of this Warrant.

9. Saturdays,

Sundays, Holidays, Etc. If the last or appointed day for the taking of any action or the expiration of any right required

or granted herein shall be a Saturday or a Sunday or shall be a legal holiday, then such action may be taken or such right may

be exercised on the next succeeding weekday which is not a legal holiday.

10. Adjustment

of Exercise Price and Number of Shares. The Exercise Price and the number of and kind of securities purchasable upon exercise

of this Warrant shall be subject to adjustment from time to time as follows:

10.1 Subdivisions,

Combinations and Other Issuances. If the Company shall at any time after the date hereof but prior to the expiration of

this Warrant subdivide its outstanding securities as to which purchase rights under this Warrant exist, by split-up or otherwise,

or combine its outstanding securities as to which purchase rights under this Warrant exist, the number of Shares as to which this

Warrant is exercisable as of the date of such subdivision, split-up or combination shall forthwith be proportionately increased

in the case of a subdivision, or proportionately decreased in the case of a combination. Appropriate adjustments shall also be

made to the Exercise Price, but the aggregate purchase price payable for the total number of Shares purchasable under this Warrant

as of such date shall remain the same.

10.2 Stock

Dividend. If at any time after the date hereof the Company declares a dividend or other distribution on its Common Stock

payable in Common Stock or other securities or rights convertible into Common Stock (“Common Stock Equivalents”)

without payment of any consideration by such holder for the additional shares of Common Stock or Common Stock Equivalents (including

the additional shares of Common Stock issuable upon exercise or conversion thereof), then the number of Shares for which this Warrant

may be exercised shall be increased as of the record date (or the date of such dividend distribution if no record date is set)

for determining which holders of Common Stock shall be entitled to receive such dividend, in proportion to the increase in the

number of outstanding shares (and shares of Common Stock issuable upon conversion of all such securities convertible into Common

Stock) of Common Stock as a result of such dividend, and the Exercise Price shall be adjusted so that the aggregate amount payable

for the purchase of all the Shares issuable hereunder immediately after the record date (or on the date of such distribution, if

applicable), for such dividend shall equal the aggregate amount so payable immediately before such record date (or on the date

of such distribution, if applicable).

10.3 Other

Distributions. If at any time after the date hereof the Company distributes to holders of its Common Stock, other than

as part of its dissolution or liquidation or the winding up of its affairs, any shares of its capital stock, any evidence of indebtedness

or any of its assets (other than cash, Common Stock or Common Stock Equivalents), then the Company may, at its option, either (i)

decrease the Exercise Price of this Warrant by an appropriate amount based upon the value distributed on each share of Common Stock

as determined in good faith by the Company’s Board of Directors, or (ii) provide by resolution of the Company’s Board

of Directors that on exercise of this Warrant, the Holder hereof shall thereafter be entitled to receive, in addition to the shares

of Common Stock otherwise receivable on exercise hereof, the number of shares or other securities or property which would have

been received had this Warrant at the time been exercised.

10.4 Effect

of Consolidation, Merger or Sale. In case of any reclassification, capital reorganization, or change of securities of the

class issuable upon exercise of this Warrant (other than a change in par value, or from par value to no par value, or from no par

value to par value, or as a result of any subdivision, combination, stock dividend or other distribution provided for in Sections

10.1, 10.2 and 10.3 above), or in case of any consolidation or merger of the Company with or into any corporation

(other than a consolidation or merger with another corporation in which the Company is the acquiring and the surviving corporation

and which does not result in any reclassification or change of outstanding securities issuable upon exercise of this Warrant),

or in case of any sale of all or substantially all of the assets of the Company, the Company, or such successor or purchasing corporation,

as the case may be, shall duly execute and deliver to the holder of this Warrant a new Warrant (in form and substance satisfactory

to the holder of this Warrant), or the Company shall make appropriate provision without the issuance of a new Warrant, so that

the holder of this Warrant shall have the right to receive, at a total purchase price not to exceed that payable upon the exercise

of the unexercised portion of this Warrant, and in lieu of the Shares theretofore issuable upon exercise of this Warrant, the kind

and amount of shares of stock, other securities, money and property receivable upon such reclassification, capital reorganization,

change, merger or sale by a holder of the number of Shares then purchasable under this Warrant. In any such case, appropriate provisions

shall be made with respect to the rights and interest of Holder so that the provisions hereof shall thereafter be applicable to

any shares of stock or other securities and property deliverable upon exercise hereof, or to any new Warrant delivered pursuant

to this Section 10.4, and appropriate adjustments shall be made to the Exercise Price per share payable hereunder, provided,

that the aggregate Exercise Price shall remain the same. The provisions of this Section 10.4 shall similarly apply to successive

reclassifications, capital reorganizations, changes, mergers and transfers.

11. Notice

of Adjustments; Notices. Whenever the Exercise Price or number of Shares purchasable hereunder shall be adjusted pursuant

to Section 10 hereof, the Company shall execute and deliver to the Holder a certificate setting forth, in reasonable detail,

the event requiring the adjustment, the amount of the adjustment, the method by which such adjustment was calculated and the Exercise

Price and number of and kind of securities purchasable hereunder after giving effect to such adjustment, and shall cause a copy

of such certificate to be mailed (by first class mail, postage prepaid) to the Holder.

12. Rights

As Stockholder; Notice to Holders. Nothing contained in this Warrant shall be construed as conferring upon the Holder or

his or its transferees the right to vote or to receive dividends or to consent or to receive notice as a stockholder in respect

of any meeting of stockholders for the election of directors of the Company or of any other matter, or any rights whatsoever as

stockholders of the Company. The Company shall give notice to the Holder by registered mail if at any time prior to the expiration

or exercise in full of the Warrants, any of the following events shall occur:

(i) a

dissolution, liquidation or winding up of the Company shall be proposed;

(ii) a

capital reorganization or reclassification of the Common Stock (other than a change in par value, or from par value to no par value,

or from no par value to par value, or as a result of any subdivision, combination, stock dividend or other distribution) or any

consolidation or merger of the Company with or into another corporation (other than a consolidation or merger with another corporation

in which the Company is the acquiring and the surviving corporation and which does not result in any reclassification or change

of outstanding securities issuable upon exercise of this Warrant), or in case of any sale of all or substantially all of the assets

of the Company; or

(iii) a

taking by the Company of a record of the holders of any class of securities for the purpose of determining the holders thereof

who are entitled to receive any dividend (other than a cash dividend) for other distribution, any right to subscribe for, purchase

or otherwise acquire any shares of stock of any class or any other securities or property, or to receive any other rights.

Such giving of notice shall be simultaneous

with (or in any event, no later than) the giving of notice to holders of Common Stock. Such notice shall specify the record date

or the date of closing the stock transfer books, as the case may be. Failure to provide such notice shall not affect the validity

of any action contemplated in this Section 12.

13. Restricted

Securities. The Holder understands that this Warrant and the Shares purchasable hereunder constitute “restricted

securities” under the federal securities laws inasmuch as they are, or will be, acquired from the Company in transactions

not involving a public offering and accordingly may not, under such laws and applicable regulations, be resold or transferred without

registration under the Act, or an applicable exemption from such registration. The Holder further acknowledges that a securities

legend to the foregoing effect shall be placed on any Shares issued to the Holder upon exercise of this Warrant.

14. Disposition

of Shares; Transferability.

14.1 Transfer.

This Warrant shall be transferable only on the books of the Company, upon delivery thereof duly endorsed by the Holder or by its

duly authorized attorney or representative, accompanied by proper evidence of succession, assignment or authority to transfer.

Upon any registration of transfer, the Company shall execute and deliver new Warrants to the person entitled thereto.

14.2 Rights,

Preferences and Privileges of Common Stock. The powers, preferences, rights, restrictions and other matters relating to

the shares of Common Stock will be as determined in the Company’s Amended and Restated Certificate of Incorporation, as amended,

as then in effect.

15. Miscellaneous.

15.1 Binding

Effect. This Warrant and the various rights and obligations arising hereunder shall be binding upon and inure to the benefit

of the parties hereto and their respective successors and assigns.

15.2 Entire

Agreement. This Warrant, the Purchase Agreement and the Registration Rights Agreement of even date herewith constitute

the entire agreement between the parties with respect to the subject matter hereof and supersede all prior and contemporaneous

agreements, whether oral or written, between the parties hereto with respect to the subject matter hereof.

15.3 Amendment

and Waiver. Any term of this Warrant may be amended and the observance of any term hereof may be waived (either generally

or in a particular instance and either retroactively or prospectively), with the written consent of the Company and the Holders

representing a majority-in-interest of the Shares underlying the Warrants pursuant to the Purchase Agreement. Any waiver or amendment

effected in accordance with this Section 15.3 shall be binding upon the Holder and the Company.

15.4 Governing

Law. This Agreement shall be governed by and construed under the laws of the State of Delaware without reference to the

conflicts of law principles thereof. The exclusive jurisdiction for any legal suit, action or proceeding arising out of or related

to this Warrant shall be either the United States District Court for the District of Minnesota.

15.5 Headings.

The headings in this Agreement are for convenience only and shall not alter or otherwise affect the meaning hereof.

15.6 Severability.

If one or more provisions of this Warrant are held to be unenforceable under applicable law, such provision shall be excluded from

this Warrant and the balance of the Warrant shall be interpreted as if such provision were so excluded and the balance shall be

enforceable in accordance with its terms.

15.7 Notices.

Unless otherwise provided, any notice required or permitted under this Warrant shall be given in the same manner as provided in

the Agreement.

IN WITNESS WHEREOF, the parties hereto

have executed and delivered this Warrant as of the date appearing on the first page of this Warrant.

| |

THE COMPANY: |

| |

|

| |

CQENS TECHNOLOGIES INC. |

| |

|

| |

By: |

|

| |

William P. Bartkowski, President and Chief Operating Officer |

ANNEX I

NOTICE OF EXERCISE OF SERIES C COMMON

STOCK PURCHASE WARRANT

To: CQENS Technologies Inc.

1. The

undersigned Holder hereby elects to purchase _____________ shares of common stock, $0.0001 par value per share (the “Shares”)

of CQENS Technologies Inc., a Delaware corporation (the “Company”), pursuant to the terms of the attached

Warrant. The Holder shall make payment of the Exercise Price by delivering the sum of $____________, in lawful money of the United

States, to the Company in accordance with the terms of the Warrant.

2. Please

deposit book entry shares totaling _________shares in the following account on the records of the Company’s Transfer Agent

or lease issue and deliver certificates representing the Warrant Shares purchased hereunder to Holder: Address:

in the following denominations: ____________________________.

Taxpayer ID No.: __________________________________

3. Please

issue a new Warrant for the unexercised portion of the attached Warrant, if any, in the name of the undersigned.

| Holder: |

|

|

| Dated: |

|

|

| By: |

|

|

| Its: |

|

|

| Address: |

|

|

4. The

undersigned is an “accredited investor” as defined in Regulation D promulgated under the Securities Act of 1933, as

amended.

SIGNATURE OF HOLDER

| Name

of Investing Entity: |

|

| Signature

of Authorized Signatory of Investing Entity: |

|

| Name

of Authorized Signatory: |

|

| Title

of Authorized Signatory: |

|

Exhibit

10.1

ASSET

PURCHASE AGREEMENT

This

Asset Purchase Agreement (“Agreement”) dated September 30, 2020, is by and between CQENS Technologies

Inc., a corporation organized under the laws of the State of Delaware and having an office for the transaction of business

at 5550 Nicollet Avenue, Minneapolis, MN 55419 (the “Buyer”), and Xten Capital Group, Inc., a

corporation organized under the laws of the State of Minnesota and having an office for the transaction of business at 5550 Nicollet

Avenue, Minneapolis, MN 55419 (the “Seller”).

WHEREAS,

the Seller owns certain patents and patent applications.

WHEREAS,

the Seller desires to convey, sell and assign to Buyer all of each Seller’s right, title and interest in and to the

Assets (as hereinafter defined), upon the terms and conditions contained in this Agreement.

WHEREAS,

the Buyer desires to purchase the Assets upon the terms and conditions contained in this Agreement.

WHEREAS,

the Seller is an Affiliate of the Buyer.

NOW

THEREFORE, in consideration of the mutual promises and other good and valuable consideration, the sufficiency of which is

hereby acknowledged, the parties agree as follows:

1.

Definitions and Interpretation.

1.1

Definitions. In this Agreement:

“Affiliate”

means, with respect to any Person, any other Person that, directly or indirectly, through one or more intermediaries, controls,

or is controlled by, or is under common control with, such Person, and the term “control” (including the terms “controlled

by” and “under common control with”) means the possession, directly or indirectly, of the power to direct or

cause the direction of the management and policies of such Person, whether through ownership of voting securities, by contract

or otherwise;

“Assets”

shall have the definition set forth in Section 2.1 of this Agreement;

“Buyer’s

Common Stock” shall mean the common stock, par value $0.0001 per share, of the Buyer;

“Commission”

means the United States Securities and Exchange Commission;

“Closing”

shall have the meaning set forth in Section 6 of this Agreement;

“Closing

Date” shall have the meaning set forth in Section 6 of this Agreement;

“Exchange

Act” means the United States Securities Exchange Act of 1934, as amended;

“Governmental

Entity” means any federal, state or local government or any court, administrative or regulatory agency or commission

or other governmental authority or agency, domestic or foreign;

“Intellectual

Property” means any of the following, to the extent that any of the following are used by Seller or held for use

by Seller in connection with the Assets as of the Closing Date: (i) all United States and foreign patent applications, patents